The Italian government has introduced significant changes to its tax residence rules through Legislative Decree No. 209, enacted on December 27, 2023. These modifications, effective from January 1, 2024, amend Article 2 of the Italian Income Tax Code (TUIR), aligning the nation’s tax regulations with international standards while clarifying long-standing uncertainties. The updated framework establishes a stronger focus on physical presence as a determining factor for tax residency, alongside traditional considerations such as domicile and registry registration. Below, we examine the key changes and their impact on both residents and individuals living abroad.

Tax Residence Determination in Italy

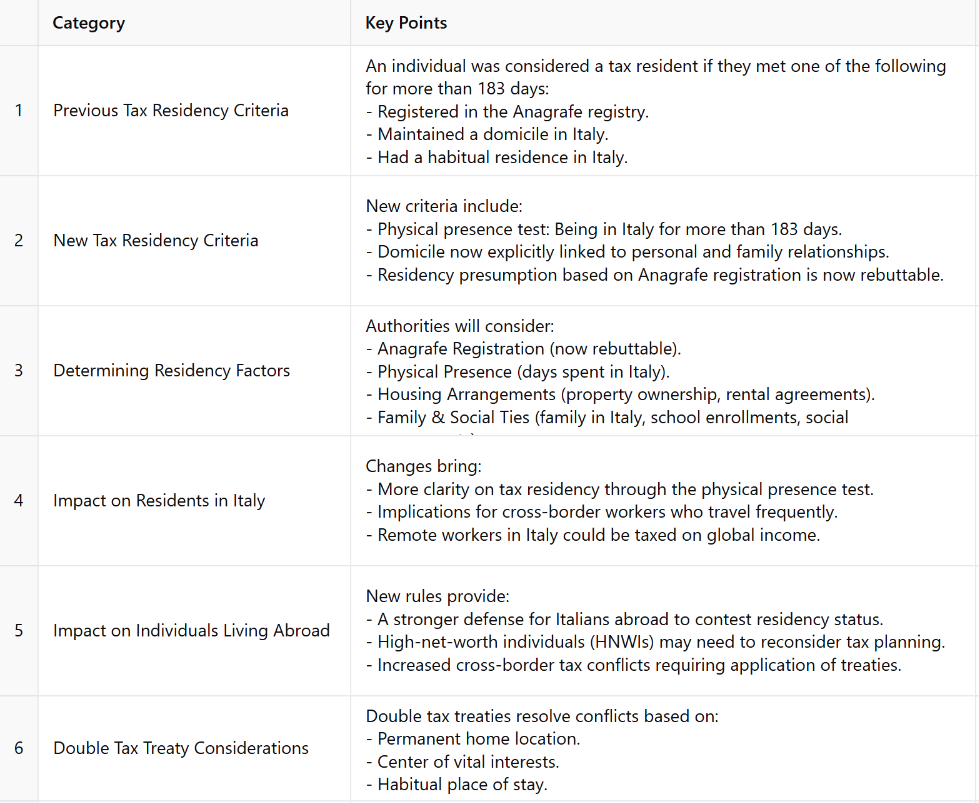

Before the reform, an individual was classified as a tax resident in Italy if they met at least one of the following conditions for more than 183 days in a given tax year:

- Being registered in the Italian resident population registry (Anagrafe della Popolazione Residente).

- Maintaining a domicile in Italy, defined as the center of personal and economic interests under the Italian Civil Code.

- Having a habitual residence in Italy.

One of the most significant issues under the previous framework was that individuals who remained listed in the Anagrafe registry—despite living abroad—were still considered Italian tax residents, leading to potential taxation on global income.

Under the revised legislation, these criteria remain, but with the following crucial changes:

- Introduction of a Physical Presence Test: Individuals physically present in Italy for more than 183 days (or 184 in a leap year) are now considered tax residents, regardless of domicile or registration status.

- Redefined Domicile Concept: Domicile is now tied explicitly to the place where an individual’s primary personal and family relationships exist, rather than economic activities.

- Rebuttable Residency Presumption: Previously, being listed in the Anagrafe registry created an automatic tax residency presumption. Now, individuals have the opportunity to present evidence to challenge their residency status.

For those residing in a country with an active double tax treaty with Italy, the treaty’s tie-breaker clause will help determine the final tax residence status. Additionally, under EU Directive 83/182/EE, individuals with family ties in multiple EU countries may be taxed in the country where their immediate family resides, provided they visit regularly.

Determining Tax Residency Status

To determine an individual’s tax residency status, the Italian tax authorities will assess multiple factual indicators, including but not limited to:

- Anagrafe Registration: While now a rebuttable presumption, being listed in the Italian registry remains a strong factor in residency determinations.

- Physical Presence: Documented evidence of staying in Italy for over 183 days, including flight records, passport stamps, and border crossings.

- Housing Arrangements: Long-term property ownership or rental agreements, utility bills, and property tax payments.

- Family and Social Ties: Presence of immediate family members in Italy, children’s school enrollments, and social engagements.

- Economic and Financial Links: Local bank accounts, credit card activity, business operations, and employment contracts.

- Healthcare and Insurance Coverage: Enrollment in the Italian National Health Service (SSN) or private health insurance policies.

- Community Participation: Memberships in gyms, clubs, or cultural organizations within Italy.

- Voting Registration: Electoral participation in Italy may further substantiate tax residence claims.

The responsibility to provide sufficient documentation rests with the taxpayer, who must be prepared to present evidence in case of a tax audit or legal challenge.

Impact on Residents in Italy

For individuals currently residing in Italy, the updated rules bring notable consequences:

- Enhanced Clarity: The adoption of an objective physical presence test reduces ambiguity, providing a clearer framework for tax residency determination.

- Implications for Cross-Border Workers: Individuals frequently traveling in and out of Italy must carefully track their days in the country to avoid unintended tax liabilities.

- Remote Work Considerations: Those working remotely from Italy for foreign employers may now fall under Italian tax residency based on their presence alone, potentially facing taxation on worldwide income.

Impact on Individuals Living Abroad

The reforms also present both opportunities and risks for those who have moved abroad or plan to relocate:

- Stronger Defense Against Residency Claims: Italian citizens listed in the Anagrafe but living overseas can now more effectively contest their Italian tax residency status by proving their domicile and physical presence elsewhere.

- High-Net-Worth Individuals (HNWIs) Adjustments: HNWIs who previously relied on residency registry status for tax planning may need to reconsider their approach in light of the new emphasis on physical presence.

- Cross-Border Tax Conflicts: These changes may lead to increased disputes between tax authorities in different countries, making the application of double taxation treaties even more critical.

Double Tax Treaty Considerations

Italy has an extensive network of double taxation treaties that provide tie-breaker rules to resolve residency conflicts. These treaties typically prioritize:

- The existence of a permanent home.

- The center of vital interests, including personal and financial ties.

- The habitual place of stay.

- Citizenship.

Even under the new rules, individuals spending more than 183 days in Italy may still be able to claim residency in another country under a treaty. However, any such claim must be well-documented to withstand scrutiny during tax audits.

Tax Planning Strategies

To mitigate tax risks and optimize financial planning under the new rules, individuals should consider the following:

- Monitor Physical Presence: Keeping detailed records of time spent in Italy can help individuals avoid unintentional tax residency status.

- Assess Domicile and Family Ties: Since domicile now focuses more on personal relationships, taxpayers should evaluate the impact of their family and social connections.

- Consult a Tax Professional: Given the complexities of international tax laws, professional advice is crucial, particularly for expatriates, cross-border workers, and HNWIs.

Final Thoughts

Italy’s revised tax residency criteria introduce greater clarity while also placing increased emphasis on physical presence. For residents, expatriates, and cross-border workers, understanding these changes is crucial to avoiding unintended tax liabilities. Whether you live in Italy full-time, spend part of the year abroad, or are considering relocation, careful tax planning and professional guidance will be key to navigating the evolving regulatory landscape.