Buying a house in Italy: What to be careful about

Buying a house in Italy may start as a dream but quickly turns into a quest of things to consider

Buying a house in Italy may start as a dream but quickly turns into a quest of things to consider

The Italian Domestic Work Visa is designed for non-EU citizens offered employment as domestic workers in Italy. Domestic work includes

Illustrating various types of Italian employment contracts, arranged on a modern office desk, complete with an elegant fountain pen and a touch of Italian flair.

Freelancer working in a vibrant outdoor setting in Italy, capturing the essence of freelance life amidst the scenic architecture of Rome.

Navigating Italy’s distinct legal and administrative framework for freelancers is crucial.

Overview of Italian Exit Tax Italy has specific rules and regulations in place regarding exit taxes, which are applicable to

How Income is Taxed in Italy In Italy, the tax authority is the Ministero dell’Economia e delle Finanze, the Minister

Depending on where you are looking long term rental in Italy, it will be very difficult or very easy to

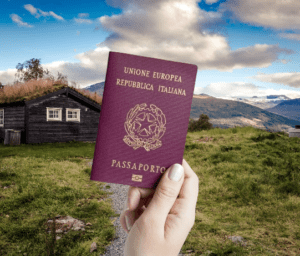

Italy is a sought-after destination for individuals considering property ownership. However, before embarking on the journey of purchasing a house

Just like every year, we are approaching the tax season in Italy; filing taxes and assessing any tax liability (or