It is divided into three levels (national, regional and municipal) and it varies according to the time you spend in Italy, your income, and your revenue sources.

In the first case, to avoid double taxation, we suggest also to check out the list of bilateral agreements regarding income tax rate, between Italy and your home country.

Table of Contents

ToggleNational, Regional and Municipal Income tax

- National Income Tax

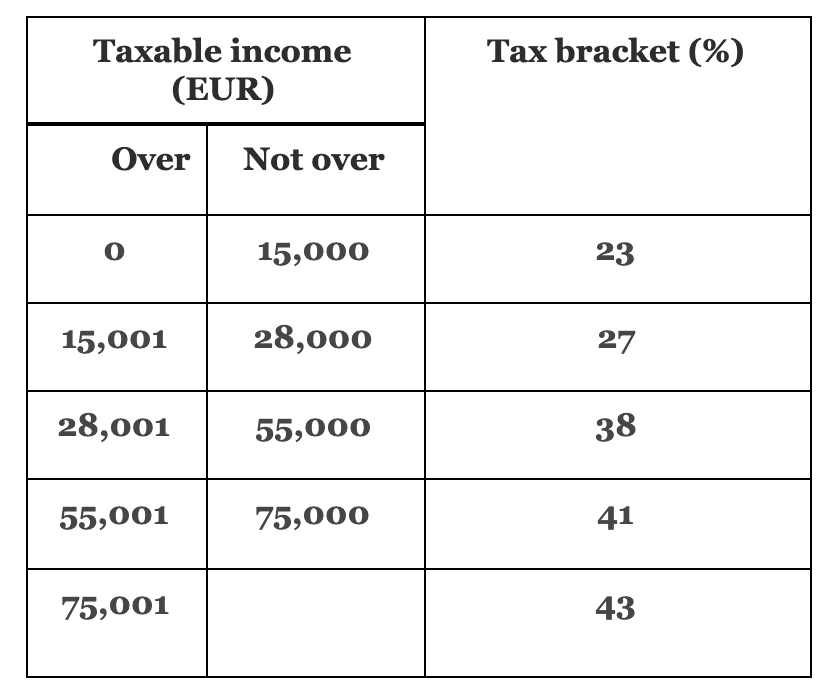

The national income tax is the core one, ranging from 23% to 43% of your taxable income.

Income taxes in Italy are progressive meaning that taxes will increase the more you earn.

1. If your income is less than € 15,000 you are subject to 23% IRPEF.

2. If your income is in excess of € 15,000 but less than € 28,000 you are subject to 25% of IRPEF.

3. If your income is in excess of € 28,001 but less than € 50,000 you are subject to 35% of IRPEF.

5. If your income is in excess of € 50,000 you are subject to 43% of IRPEF.

All the data summed up in the table below.

source: tradingeconomics.com

Regional surcharge is in addition to the national income tax and it is calculated on the same taxable income. Regional taxes vary from 0,9% to 1,4% of your income depending on the region.

The Municipal tax depends on the municipality in which you reside. It varies between 0,1 and 0,8% of your income.

What can be considered as income generated in Italy?

- Business income from a resident company in Italy

- Pension sourced from Italy

- Income coming from Italian patent or trademark. In this case it should be paid by the Italian state or Italian residents.

- Italian financial income and capital gains

- Income from an Italian employment contract, or freelancer’s activity (check out our article regarding freelancer taxes in Italy)

Is my pension taxed?

When is the tax deadline?

The general tax deadline is November 30th, which is anticipated to June 30th if you file your paper return at the tax office. Should you opt for the 730 filing, which guarantees a faster tax refund, the filing deadline is set on September 30th.

If you miss the November 30th deadline, you can submit a late filing within 90 days (up to February 28th of the following year) paying a small € 25 late submission penalty. Failure to meet the ultimate deadline is a total disaster because you are then subject to a minimum fine of € 250 for late filing, on top of a variable fine ranging from 120% to 240% of any tax due, as well as a minimum fine calculated as 3% on your foreign held assets.

There are no amnesty procedures, nor mitigating factors. The best strategy at your disposal is to file on time!

When should you pay these taxes?

Paying taxes as an employee in Italy

If you are employed in Italy, you do not have other sources of income, and you do not claim any tax deductible item, you should not worry about filing your tax return since the PAYE system has already deducted your income tax monthly through your payslip.

Other taxes to consider

- Wealth tax on properties owned out of Italy

If you have real estate possession outside Italy you should pay a tax equivalent to the percentage of the property you own, and its size. The tax is called IVIE (Imposta sul valore degli immobili situati all’estero) and it is 0,76% of the cadastral value of the property, but it can vary according to the type of property (luxury or normal) and its destination of usage (commercial, residential, agricultural…).

IVIE is assessed on the same value used for property tax purposes in the foreign jurisdiction; furtheremo

2. Wealth tax on financial investments owned out of Italy

Also, this wealth tax is proportionate to the percentage owned and the size of the asset. This is called IVAFE, which stands for “Imposta sul valore delle attività finanziarie detenute all’estero”. In general, this is 0,2% of the value of the asset.

Bank accounts are subject to fixed € 34 wealth tax, regardless of the amount at year end, whilst private foreign pension funds (i.e. 401k) funds do not attract wealth tax.

Cryptos have to be disclosed in the form, however, generally, there is no wealth tax to pay.

Both IVAFE and IVIE must be paid in two installments: June 30th and November 30th.

Are there any tax breaks?

- For instance, if you earn less than 8K per year as a regular employee this tax is not due.

- If you are 75 or younger, and you earn 7500 € per year you should not pay IRPEF.

- If you are 75 or older, and you earn 7750 € per year you should not pay it as well.

In addition to this there are various expenses that

- Health expenses;

- Education expenses;

- Kindergarten fees;

- University fees;

- House renovations;

- Facade Bonus;

- Complimentary pension contributions;

- INPS payments;

- Rental paid;

- Mortgage interest on primary home purchase;

- Bonus mobili;

- Superbonus 110%;

- Foreign tax credits;

Since 2022, you need to claim your child tax credit directly through the INPS website which will deposit the monthly tax credit directly in your bank account. Here I made a video explaining the whole process.

Furthermore, from 2019 Italy has also introduced a new tax exemption to attract retired people in Italy, which will guarantee you a 7% flat tax on any foreign income. With this and many more improvements, taxation in Italy is trying to become more competitive and appealing to foreigners.

Final considerations

Furthermore, there may be many exemptions and deductions you have not considered or there might be conflicts between the Italian tax system and your home country one..

To be sure, we strongly suggest you check out your numbers with an international accountant in Italy, to be 100% law compliant.

In addition, check out our video below, about essential tips and suggestions to pay taxes in Italy.

Want to read more? Check out also our articles about filing your taxes in Italy, or airbnb taxes in Italy, or our guide for retiring in Italy.