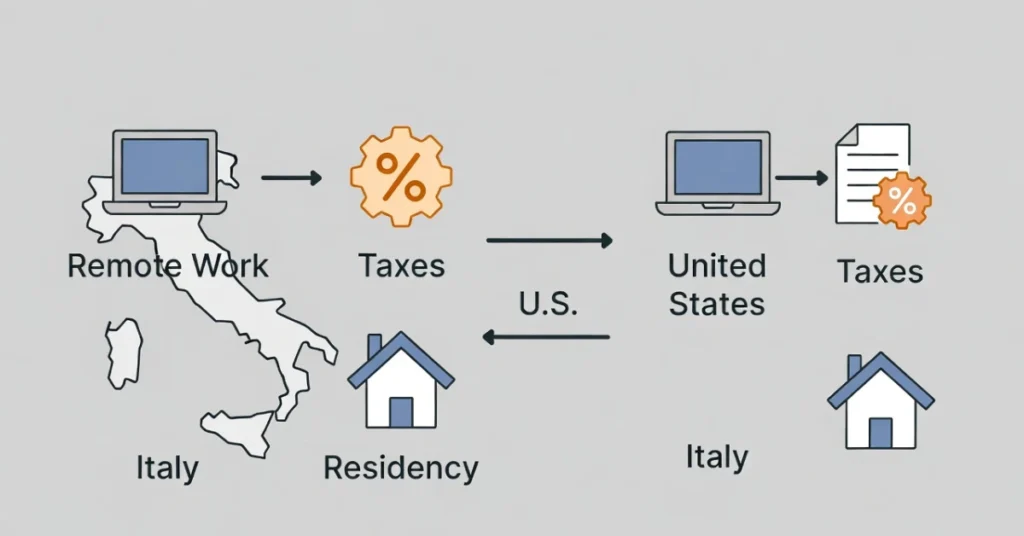

Living in Italy as an American contractor is a relatively simple concept on paper. You get to keep your US clients, work your job remotely from a café or home office, and live a more relaxed and luxurious lifestyle.

The problem is that tax law does not view it as a choice, and you’re working in Italy the moment you make the move and stay long enough to become a tax resident of Italy. Once you become a tax resident of Italy, your money is no longer just “US money.” It is subject to Italian tax and reporting, even though all your clients are still located within the United States, and all your money is deposited into a US bank account.

At the same time, nothing about your move cancels your US obligations. As an American contractor, you are still required to file US tax returns, report worldwide income, and comply with US rules while potentially paying taxes in Italy as well.

Table of Contents

ToggleWhen Italy Considers You a Tax Resident

An individual is generally considered a tax resident of Italy if physically present for more than 183 days during a calendar year.

Main points relevant to remote contractors:

- Days do not need to be consecutive

- Partial days are included

- Immigration or tourist status does not affect tax residency

- Remote work performed while physically in Italy is considered work carried out in Italy

Once the 183-day threshold is exceeded, Italy acquires the right to tax the individual’s worldwide income.

The Center of Vital Interests Test

Even if the 183-day threshold is not met, Italy may still classify an individual as a tax resident if their center of vital interests is located in Italy.

This assessment considers both personal and economic factors, including:

- Location of the primary residence or long-term accommodation

- A place where professional activity is effectively carried out

- Economic ties, including banking and contractual activity

- Family presence and personal relationships

For independent contractors, this test is particularly relevant because professional activity is not linked to a foreign employer’s physical location. When services are performed remotely from Italy, the activity is generally regarded as carried out in Italy.

Why Independent Contractors Are More Exposed

Unlike employees working abroad under structured employment arrangements, independent contractors determine where their services are performed.

From an Italian tax perspective:

- The place of work is where the contractor is physically located

- Business activity follows the individual, not the client

- Income generated from remote work is attributable to Italy when performed there

As a result, American contractors often meet Italian tax residency criteria during their first year of living in Italy, even without formal registration.

Indicators That May Trigger Tax Residency Recognition

Italian tax authorities, including the Agenzia delle Entrate, may infer tax residency based on objective indicators such as:

- Registration with the local population registry (Anagrafe)

- Application for a long-term residence permit

- Execution of long-term rental agreements

- Use of Italian bank accounts for ordinary living expenses

- Continuous physical presence while performing remote work

Formal declaration is not required for tax residency to arise.

Has the OECD Changed the Rules for Remote Workers in Italy?

Recent OECD commentary and administrative interpretations clarified how remote work is treated under international tax standards.

During the pandemic, temporary guidance suggested that remote work performed due to extraordinary circumstances would not automatically shift taxing rights between countries. However, those temporary administrative positions have largely expired.

Under current OECD principles:

- The place where work is physically performed remains the primary factor for allocating taxing rights.

- Remote work carried out habitually from a country is generally treated as activity performed in that country.

- Long-term presence combined with economic activity strengthens residency classification.

For American contractors living in Italy, this means that remote work performed from Italy is typically considered Italian-source activity once tax residency arises. The OECD framework supports Italy’s position that physical presence determines where professional activity is exercised.

Italian Tax Office Position

The Agenzia delle Entrate has confirmed in official rulings that professional services are considered performed in Italy when the individual is physically present in Italy while carrying out the activity, even if clients are located abroad, and payments are received in foreign accounts.

Main elements emphasized in administrative practice include:

- The decisive factor is the place where the activity is materially performed, not where the client is established.

- The location of bank accounts receiving payment is irrelevant for source-of-income analysis.

- Remote work performed habitually from Italy constitutes activity exercised in Italy.

- Italian tax residency combined with professional activity in Italy supports full taxation of worldwide income.

- Formal contractual wording does not override the factual place of performance.

This administrative position aligns with OECD principles and has been consistently applied in residency and income-source assessments.

Can the Impatriate Regime Apply to American Contractors?

While OECD standards support Italy’s right to tax remote work performed in Italy, Italian domestic law provides a potential mitigation tool: the impatriate regime (Regime degli Impatriati).

Under the current legislation (as amended in recent reforms):

- A percentage of employment or self-employment income may be excluded from Italian taxation.

- The benefit applies for a limited number of years.

- The individual must not have been tax resident in Italy for a specified period prior to relocation.

- A commitment to remain in Italy for a minimum duration is required.

- Professional activity must be carried out predominantly in Italy.

For independent contractors, the regime may apply if:

- The individual transfers tax residence to Italy;

- Registers professional activity correctly;

- Meets the statutory non-residence and duration requirements.

This means that although Italy taxes worldwide income once residency is established, qualifying individuals may significantly reduce their effective Italian tax burden during the initial years of residence.

What Happens Once You Become an Italian Tax Resident

Once Italian tax residency is established, the applicable tax framework changes substantially. From this point forward, Italian tax law applies in full, regardless of nationality, the location of clients, or where income is paid.

Worldwide Income and Italian Taxation

An individual classified as an Italian tax resident is subject to Italian tax on worldwide income. This includes income earned from US clients, payments received in US bank accounts, and fees invoiced under US contracts. The determining factor is not the origin of the income, but the individual’s residence and physical location while performing the work.

For American contractors living in Italy, income derived from remote work is fully within the Italian tax base once residency applies.

Treatment of Remote Work Income

Italian tax authorities follow the principle that professional activity is carried out where the individual is physically present when performing the work. As a result, remote work performed from Italy is treated as work carried out in Italy, even if clients and contractual counterparties are located abroad.

This interpretation is consistently applied by the Agenzia delle Entrate and aligns with international tax standards.

Compliance and Filing Obligations

After becoming a tax resident, an American contractor is required to comply with Italian filing and reporting obligations. This includes submitting an annual Italian income tax return, declaring worldwide income, and reporting qualifying foreign financial assets. Income tax and social security contributions must be paid in accordance with Italian law.

Failure to comply does not prevent taxation from arising. Instead, it may result in retroactive assessments, interest charges, and administrative penalties once the tax position is reviewed.

Interaction With US Tax Rules

Italian tax residency does not eliminate US tax obligations. US citizens remain subject to US filing requirements on worldwide income, regardless of where they live. This results in overlapping tax systems, where the same income may be subject to taxation in both jurisdictions.

Without appropriate planning and coordination, this overlap commonly leads to double taxation or temporary double payments before relief mechanisms are applied.

Italian Tax Obligations for American Contractors

Once tax residency is established, American contractors become fully subject to Italian tax law. The obligations extend beyond income tax and include registration requirements, social security contributions, and ongoing reporting duties.

Income Tax Framework Applicable to Contractors

Self-employed individuals in Italy are generally taxed under the personal income tax system (IRPEF) unless they qualify for a special regime. Ordinary IRPEF taxation is progressive, with rates increasing as taxable income rises, and is supplemented by regional and municipal surtaxes.

For contractors, taxable income is calculated by deducting allowable business expenses from gross professional income. Income derived from remote work is included in the Italian tax base when the work is performed while living in Italy, regardless of where clients are located or where payments are received.

VAT (IVA) Considerations

Value Added Tax (IVA) obligations depend on the nature of the services provided and the location of clients. Many services supplied to non-EU business clients may fall under reverse-charge or VAT-exempt rules. However, VAT registration may still be required even when no Italian VAT is ultimately charged.

The absence of VAT charged on invoices does not eliminate the obligation to register, file periodic VAT reports, or submit annual VAT declarations when applicable.

Social Security Contributions (INPS)

Independent contractors are generally required to contribute to the Italian social security system through the INPS. Contributions are calculated as a percentage of taxable income and are separate from income tax liabilities.

For American contractors, social security is often overlooked. However, once professional activity is carried out in Italy on a habitual basis, INPS registration is typically mandatory unless a specific exemption applies under international agreements.

Reporting and Filing Requirements

Italian tax compliance includes annual income tax filings, periodic advance tax payments, and, where applicable, VAT and social security filings. Contractors must also report certain foreign financial assets and accounts held outside Italy.

Deadlines are strictly enforced, and late or incomplete filings can result in penalties and interest charges assessed by the Agenzia delle Entrate.

Paying Taxes in Italy and the United States at the Same Time

For American contractors, one of the most complex aspects of living in Italy is the obligation to comply with two tax systems simultaneously. Italian tax residency does not replace US tax obligations. Instead, it creates an overlap that must be managed carefully to avoid errors, penalties, or unnecessary double taxation.

Citizenship-Based Taxation in the United States

The United States applies a citizenship-based taxation system. This means that US citizens are required to file US tax returns and report worldwide income regardless of where they live or work.

As a result, even after becoming a tax resident of Italy, an American contractor must continue to:

- File an annual US federal income tax return

- Report the worldwide income

- Comply with US information reporting requirements

This obligation exists independently of whether taxes are already paid in Italy.

Residency-Based Taxation in Italy

Italy, by contrast, applies a residency-based taxation system. Once an individual qualifies as an Italian tax resident, Italy taxes their worldwide income, including income earned from remote work performed in Italy for foreign clients.

From Italy’s perspective, the same income that must be reported to the United States is also subject to Italian tax because:

- The individual is resident in Italy

- The work is physically performed in Italy

This is the legal basis for overlapping tax claims.

Why Double Taxation Occurs in Practice

Double taxation does not arise because of an error, but because both countries have a legal right to tax the same income under their domestic laws.

For American contractors, this commonly results in the following situation:

- Income is taxable in Italy due to tax residency and work location

- The same income remains reportable and taxable in the United States due to citizenship

Without applying relief mechanisms, this would result in paying taxes twice on the same earnings.

Timing and Cash Flow Issues

Even when relief is available, timing differences between the two tax systems often create cash flow problems. Italian taxes are typically paid during the year through advance payments, while US tax relief is claimed later when filing the US return.

This can lead to temporary double payments before credits or exclusions are applied through the US tax system administered by the Internal Revenue Service.

How the US-Italy Tax Treaty Applies to American Contractors

The tax treaty between the United States and Italy is designed to reduce double taxation and allocate taxing rights between the two countries. However, it does not eliminate tax obligations for American contractors living in Italy, nor does it remove US filing requirements.

What the Treaty Is Intended to Do

The primary purpose of the US–Italy tax treaty is to prevent the same income from being taxed twice without relief. It establishes rules for determining which country has primary taxing rights over specific categories of income and provides mechanisms to mitigate double taxation.

For self-employed individuals, the treaty generally allows Italy to tax income when:

- The individual is an Italian tax resident, and

- The professional activity is carried out in Italy

This aligns with Italian domestic law, which treats remote work performed in Italy as Italian-source activity once residency is established.

What the Treaty Does Not Do

The treaty does not exempt US citizens from US taxation. The United States preserves its right to tax its citizens under a “saving clause” included in the treaty. As a result:

- US filing obligations remain unchanged

- Worldwide income must still be reported to US authorities

- Treaty provisions do not override citizenship-based taxation

This is a critical distinction that many contractors misunderstand when relying on treaty language alone.

Practical Impact for Contractors

In practice, the treaty allows relief from double taxation primarily through tax credits, not exemptions. Italian tax is usually paid first due to residency and work location, and relief is then claimed on the US side through the foreign tax credit mechanism administered by the Internal Revenue Service.

The treaty does not eliminate the need for:

- Italian tax registration and compliance

- US tax filings and disclosures

- Coordinated planning across both systems

Before You Pay Your Taxes in Italy

Living in Italy as an American contractor involves more than a change of location. It creates a dual tax exposure that must be addressed deliberately and correctly. Once Italian tax residency is established, Italy taxes worldwide income, including income earned from remote work performed in Italy. At the same time, US tax obligations continue without interruption.

Double taxation arises not from error, but from the interaction of two lawful systems: residency-based taxation in Italy and citizenship-based taxation in the United States. While tax treaties and relief mechanisms exist, they do not remove filing obligations or eliminate the need for proper registration, reporting, and payment in both countries. For American contractors planning to move to Italy, the main point is planning. You need to clearly understand when tax residency begins, how Italian tax law treats remote work, and how US compliance continues in parallel, allowing contractors to structure their affairs correctly, avoid penalties, and manage their overall tax burden effectively.

Would you like to read more about similar subjects? Take a look at our related articles here: donation in Italy, Ritenuta d’Acconto Italy and ATECO code Italy.

🇮🇹 Living in Italy as an American Contractor: Tax Survival Quiz

1. When does Italy generally consider you a tax resident?

After 90 daysAfter 183+ days in a calendar year

Only after getting citizenship

2. Do the 183 days need to be consecutive?

Yes, like a Netflix bingeOnly if you stay in Rome

No, they can be spread out

3. Remote work performed while physically in Italy is considered…

Work carried out in ItalyWork carried out in the US

Work carried out in “tax heaven”

4. Even without 183 days, Italy may still tax you if…

You eat too much pastaYour center of vital interests is in Italy

You buy an espresso machine

5. Why are independent contractors more exposed to Italian taxation?

Because Italians love freelancersBecause clients decide tax rules

Because work follows where the contractor is physically located

6. Which of these may trigger Italian residency recognition?

Registering with the AnagrafeWatching Italian soccer

Buying gelato daily

7. Under OECD principles, taxing rights depend mostly on…

Your client’s addressWhere the work is physically performed

The currency you’re paid in

8. Agenzia delle Entrate says bank account location is…

The most important factorSlightly important

Totally irrelevant for source-of-income analysis

9. What regime may reduce taxes for newcomers?

Impatriate Regime (Regime degli Impatriati)Free Pizza Tax Program

Tourist Discount Scheme

10. Does moving to Italy cancel US tax obligations?

Yes, goodbye IRS foreverNo, US citizens still file worldwide income

Only if you live near Venice