Italy is full of opportunities both in the tourism sector and in many rising cities. The real estate sector is particularly dynamic in the cities with a lot of universities such as Milan, Turin, Bologna, Trent and Bolzen to mention a few. However many are willing to bet on the southern regions such as Sicily and Reggio Calabria, where the tourism industry is steadily rising, and many great deals can still be made.

Whatever your intentions are, there are many costs, taxes and hidden fees to take into considerations when buying a house in Italy.

Behind many so called “real estate deals” there could be many laws, rules and hidden fees you should be aware of.

If you want an extensive overview of the taxes you should pay when owning a property in Italy check our article about property tax in Italy.

1. The essential Taxes

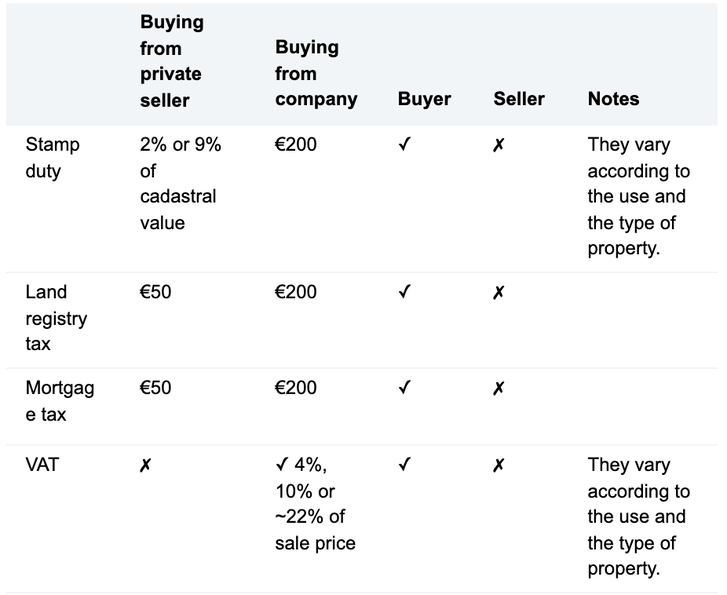

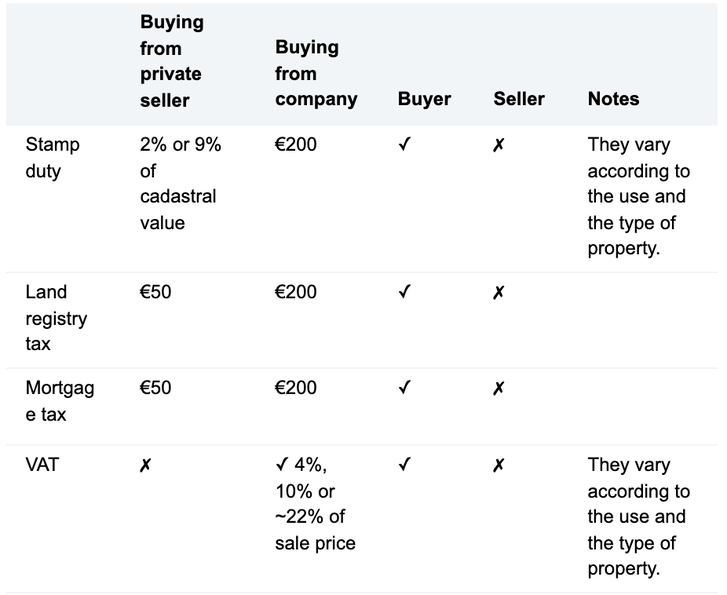

- Stamp Duty

There are many variations of this tax according to the use and the type of house you are buying.

- If the house you are buying is going to be your primary property (meaning that you are going to live there more than 6 months per year) and you buy this house from a private seller, this tax will amount to 2% of the cadastral value of the property. However it will never be less than 1000€.

- If you are buying from a private seller but your house is going to be secondary (meaning you are living there for less than 6 months in a year) this tax will be 9% of the cadastral value of the property.

- If you are buying from a registered company (such as a real estate agency or a constructors’ one), and you’re purchasing your primary house the stamp duty will amount to 200€.

- If you are buying from a registered company a second house, you stamp duty will be 200€ as well.

The first tip is that you have the option to declare to the Revenue Agency (Agenzia delle Entrate in Italian) the fact that you will become resident in Italy within 18 months after the purchase so that you stamp duty tax could be as written in option one and three.

The second tip is to look carefully at what is the cadastral value of the property, as many properties in Italy are quite old and their value on the market is not updated yet. Many times the cadastral value is set in the deed of sale of the house, and therefore it does not change when the property has the same owner for years.

The third tip is that if your house has not finished, or it is a development project, you don’t need to pay any stamp duty.

2. Land registry Tax

The land registry tax, or “imposta catastale” in Italian, is the tax due when a house or a property changes its owner in the cadastral lists of the government.

- If you are buying a house from a private seller will only cost 50€ to you.

- If you are buying a house from a registered company it will cost 200€.

3. The Mortgage Tax

The mortgage tax or in Italian “imposta ipotecaria” is also a fixed tax.

- If you are buying a house from a private seller, it will cost 50€ to you.

- If you are buying a house from an agency or another company, it will amount to 200€.

4. The VAT Tax

The vat tax or “IVA” in Italian is due also on properties’ purchases.

- If you are buying from a private, you should not pay this tax.

- If you are buying from a business the tax can vary according to different types of purchases.

- It will be 4% if you are buying your primary house

- it will be 10% if you are buying your secondary house

- it will be 22% if the house you are purchasing is a luxury one.

Here is a useful scheme about the taxes made by Transferwise.

This tax is due in Italy in every contract but it is not that high. “Marca da bollo” or simply “bollo” is a stamp that you can buy from a local corner shop.

In general is 2% for the invoice or receipt over 77€.

In case you go through with your decision, you will pay 16€ for the notary’s documents (see below) or other public administration contract.

2. Law Taxes

To validate your contract and control that the transaction is proceeding according to law, you should get in contact with a notary, or notaio. Usually the seller chooses the person to contact.

In his presence you will sign the deed of sale (see section below).

He will give copies of the contract to the tax office and land registry institution, informing the local police of the change of ownership.

3. Intermediation fee

- Agency fee

If you are purchasing the house from a real estate agency or a real estate agent, bear in mind a certain percentage of the transaction value should be paid to them. This sum varies from agency to agency.

In general they always ask between 1% and 5% of the property’s value, but it depends from city to city, and from company to company.2. Other intermediation costs

If you are buying an office, a warehouse or a storage area, keep in mind that changing its purpose of use, may not be so easy. To be 100% law compliant, you will need to fill many documents and present to the municipality where the property is located.

They may as well refuse your demand and sometimes you will need to go through expensive restorations’ works.

4. Construction costs: essential info

These are costs that often you cannot avoid.

For the rest, make sure to have an estimate by the seller regarding the renewal or restoration costs of the house you are going to buy.

It may be convenient to have a final consultation from a civil engineer in order to check the plans of the house and its condition, especially if the house is old.

5. Signing a contract

Then you are ready to buy your first house in Italy.

In general the process is divided into three steps but it can vary according to real estate agencies or deals made.

- Once the seller and you agree on the sum to be paid for the property, the seller will ask you for some money to be paid as a deposit, as a proof of the seriousness of your intentions. This is called “proposta” or proposal of purchase. The amount requested in this phase can vary. It can be as little as 2000€.

However in case you decide not to proceed with the purchase, the money will be given back to you unless agreed otherwise. - After that, there is the “preliminare” or in english preliminary contract. Also in this case, the seller will ask you for a deposit, bigger than the previous one.

In general this deposit may vary according to the property and its value. In general 5-20% of the property value may be asked at this stage.

At this stage in general, you will also pay the agency fees.

If the seller decides to leave the process, according to the Italian law, it may be liable to pay double of what has been given as deposit.

- Last there is the final deed of sale or rogito. With this one the transaction and the purchase is formalized and the change of ownership is finally completed. This deed of sale is where most of the money get paid.

It is done in front of the notary and by this term all the essential taxes listed below must already be paid.

Keep in mind that the terms and deadlines of the payment for the entire house are quite negotiable. Especially when your purchase is dependent on a bank loan or other lendings.

As well as the payment amount to be paid at stage one and two of the process, can be discussed.

We hope this article has been useful and you are finally ready to buy your first house in Italy. Wether is for living in it or as holiday home, buying a property in Italy could really be a good investment.

If you want to study further topic check out our guidebook to buy a house in Italy.

Want to read more? Check out also our articles about filing your taxes in Italy, or airbnb taxes in Italy, or our guide for retiring in Italy.

cfaugiana03@gmail.com

I have just recently bought a property in Italy , I’m a foreigner , I was told there is a risk fee . 2900 that needs to still be paid . I’m not sure what this for . And if i really need it .

I’m looking for guidance .

I quite enjoyed reading it, you are a great author.I will be sure to bookmark your blog and definitely will come back sometime soon. I want to encourage you to continue your great writing, have a nice holiday weekend!

I’m truly grateful for this comprehensive article! I’ve been considering a move to Italy for years, but I always wondered, ‘how much do houses in Italy cost?’ Your detailed insights and comparisons across different regions provided exactly the clarity I needed. Thank you for such a valuable resource

Thank you for this enlightening piece! The question of ‘how much do houses in Italy cost?’ has been on my mind as I dream of retiring in the Italian countryside. Your article not only answered my question but also gave me a better understanding of the Italian real estate market. Much appreciated

The additional tips on navigating the buying process were a bonus. Thank you for sharing your knowledge!

I can’t thank you enough for this article! My partner and I have been pondering over ‘how much do houses in Italy cost?’ as we plan our move, and your detailed breakdown of prices in various regions has been incredibly helpful. Your advice on what to look out for when buying a property in Italy is invaluable. Thanks again

Wow, what a fantastic read! I’ve always been curious about ‘how much do houses in Italy cost?’, and your article provided more than just numbers. The insights into the lifestyle, culture, and legalities of buying a house in Italy were eye-opening. Thank you for such an informative and engaging article!

Thank you for the insightful article on the costs of homes in Italy! The detailed breakdown of prices across different regions was incredibly helpful. It’s fascinating to see how much variation exists from one area to another. This information is invaluable for anyone considering a move or investment in Italy. Could you perhaps delve deeper into what drives these regional price differences in a future piece?

I’m truly grateful for the comprehensive guide on purchasing property in Italy. The step-by-step process and the mention of additional costs beyond the purchase price were particularly enlightening. It’s clear that a lot of research went into this, and it significantly demystifies the process for first-time buyers like myself. Thanks for sharing such valuable insights!

This article was a treasure trove of information for someone exploring the idea of living in Italy. The tips on navigating the real estate market and understanding local nuances were spot on. Thank you for highlighting the importance of location in determining house prices in Italy. It prompts me to think more critically about where I might want to settle. Keep up the great work!

I appreciate the effort put into explaining the intricacies of the Italian housing market. The comparison between urban and rural property prices was particularly eye-opening. Thanks for shedding light on how much a house in Italy might cost and for providing such a thorough analysis. It’s articles like these that make the daunting task of buying property abroad seem more approachable

Thanks for such a detailed and informative piece on the costs associated with buying a house in Italy. The inclusion of various factors that affect house prices, from historical significance to proximity to amenities, was very thoughtful. It’s clear that finding the right property in Italy is about balancing desires with reality. Could you offer more insight into how the Italian real estate market is expected to trend in the coming years?

I read many of your blog posts, and I’m always impressed by the quality of your content.

Thanks for sharing. I read many of your blog posts; your insights are amazing!

Every time I visit your blog, I come away with new knowledge. Thanks for the great work!

Great insights! Your article was very thorough and informative. Thanks a lot!

Thanks a lot for sharing this with all of us you really know what you’re talking about! Bookmarked.

Great job on the article! It’s rare to see such a perfect blend of information and readability.

Thank you for your hard work on this article. It’s made a big difference in how I view this subject.

I’ve shared this post with my friends. It’s too good not to spread around!

Lovely site! I am loving it!! Will be back later to read some more. I am taking your feeds also.