Several European (and non European) countries have a small business tax regime, which provides certain simplifications as well as reduced taxation to businesses within a certain threshold.

Since 2015, Italy has introduced the Regime Forfetario, which has been amended various times throughout its life span. The 2023 budget law has introduced new rules for individuals in such regime. Find out the major changes in this article.

What will change for Regime Forfetario in 2023?

First, and foremost, the revenue threshold of € 65,000 has been uplifted to € 85,000. However, in accordance with the EU Directive 2020/285 you are immediately disqualified from this regime if your revenues are in excess of € 100,000.

This also means that if you made between € 65,000 and € 85,000 during the year 2022, you can still qualify for the Regime Forfetario for the year 2023.

In addition to that, the budget law mandates the E-invoicing adoption for all the taxpayers in the Regime Forfetario starting from January 1st 2024. For the year 2023, individuals who make € 25,000 or less can still use a paper based invoicing system.

AccountingBolla has developed the first E-invoicing solution in English for Italian businesses. Subscribe here

Who can access the Regime Forfetario?

In order to access the Regime Forfetario you must first acquire a Partita IVA and in its application you must check the Regime Forfetario option. You are disqualified from accessing this regime if any of the following conditions apply:

- You make more than € 85,000 of self employment income during any given year;

- You pay more than € 20,000 of salaries per year;

- You already opt for special VAT regimes (e.g. bookstores, tobacconists etc.)

- As a non Italian resident you make less than 75% of your income in the European Economic Area;

- You freelance EXCLUSIVELY for your past employer;

- You made more than € 30,000 in employment income in the previous tax year;

- You control, directly or indirectly, a business or a corporation in the same business area.

If none of the above conditions apply to you you can qualify for the Regime Forfetario!

How much tax do I pay under the Regime Forfetario?

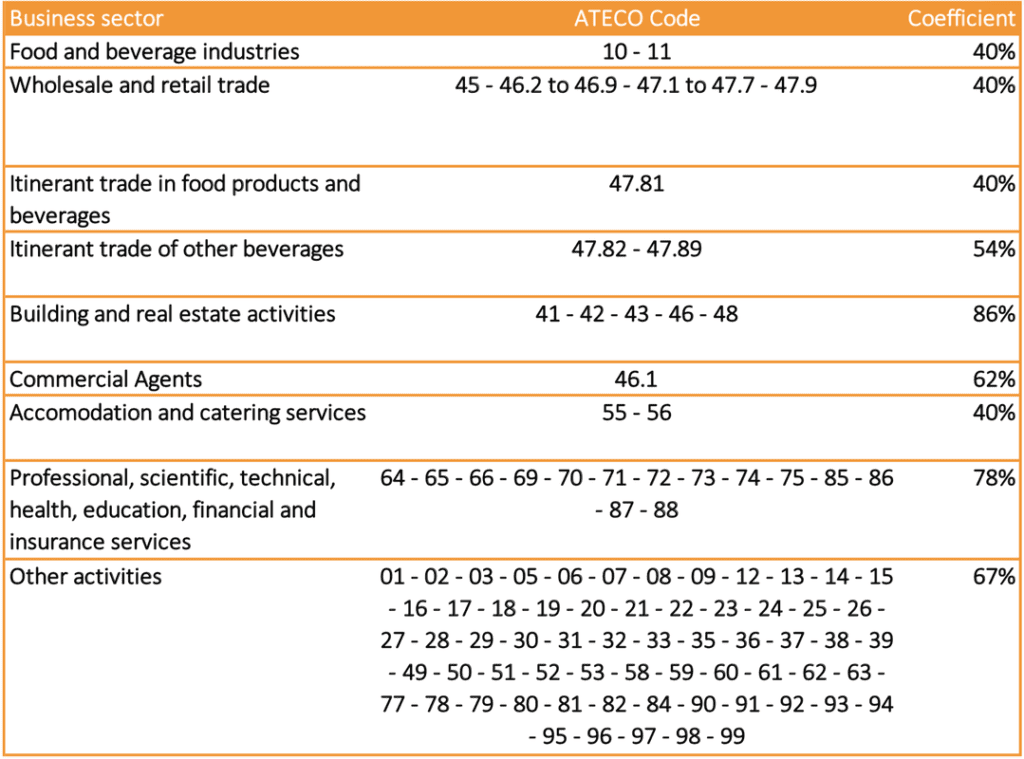

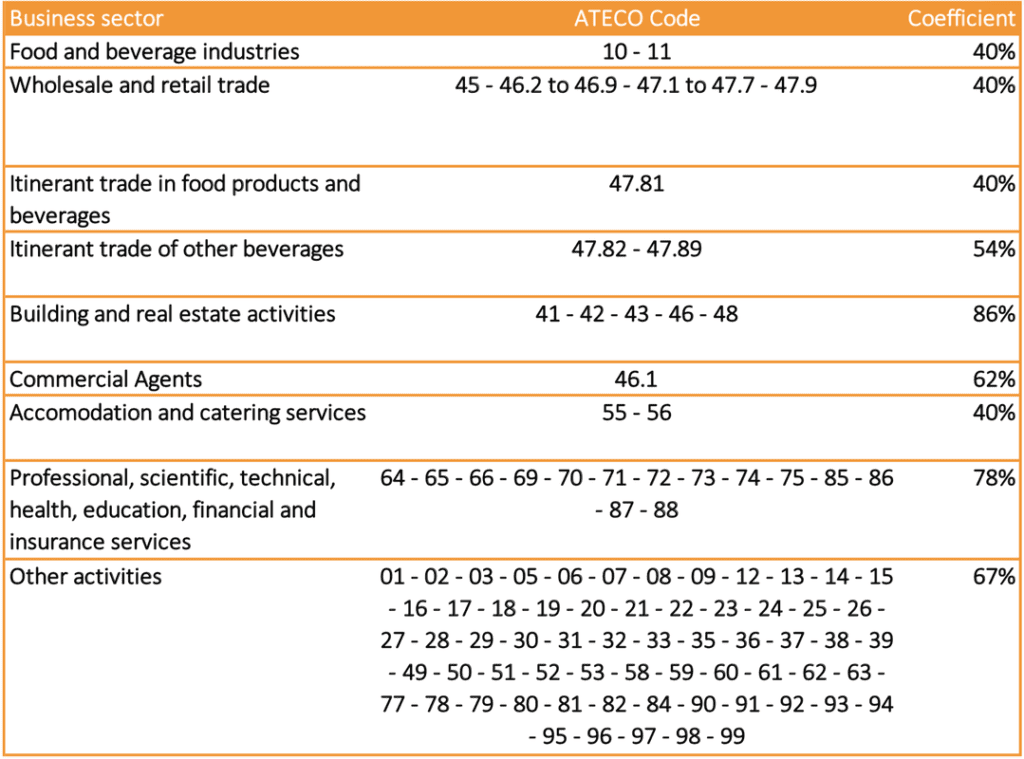

The flat-rate scheme charges a flat income tax rate of 15% tax on the gross turnover after the below chart coefficient application. This tax is levied in place of the progressive IRPEF brackets with no recourse on costs suffered.

If a self employed teacher will pay tax on 78% of gross earnings at a rate of 15% – an effective rate of 11.7% of gross income invoiced to clients. The rate is reduced to 5% for a new business activity – defined as one being carried out for the first time and not an extension of a previous business carried out under the ordinary regime or a prior special scheme. This means that you will suffer an effective rate of tax of 3.9% of turnover.The maximum annual revenue threshold is € 85,000 per tax year.

What about INPS payments?

Italy has two different National Insurance contribution schemes:

- Gestione Artigiani e commercianti

- Gestione Separata

If you work in commerce, trade, or manufacturing, you must enrol in the Gestione Artigiani e Commercianti. This is a scheme based on a quarterly flat fee independent of your income, and an annual surcharge based on the actual income earned during a given year. If you opt for the Regime Forfetario, you can claim a 35% reduction of such payments.

Freelancers must enrol in the Gestione Separata, paying a flat 25.98% on their income. Despite this regime is slightly more expensive compared to the Gestione Artigiani e Commercianti; if you don’t make any money, you don’t owe any INPS payment.

Note that your INPS income is calculated as: Revenue * Coefficient

Are there any other advantages in the Regime Forfetario?

On top of the reduced 5% tax rate, the Regime Forfetario is a valid scheme to reduce the bureaucracy connected to the annual tax compliance:

- No VAT needs to be charged on invoices issued and there is no VAT reporting/compliance – e.g. no annual VAT return etc. This also provides a competitive advantage when you do business B2C since you don’t charge VAT

- Simplified bookkeeping – no need to register invoices and receipts, purchase and sales invoices in statutory registers;

- No Ritenuta d’acconto or withholding tax on your invoices

- Exemption from the “Esterometro” and “Spesometro” – the rules that work to stop excess tax deductions for costs in relation to gross income and the parameters deriving from industry sector studies.

- Exemption from ISA tax office audits;

- Cheaper accounting and compliance costs;

- No regional production tax (IRAP).

What happens if I make more than € 85,000?

Upon passing the threshold of € 85,000 you are not eligible for the Regime Forfetario and you will shift to the IRPEF brackets scheme from the FOLLOWING TAX YEAR if your total income does not exceed € 100,000. If you pass € 100,000 in income, you are immediately disqualified from such regime and you must compute and pay VAT on your invoices raised.

Is this the best regime available?

Despite the very attractive 5% flat tax rate, this regime might not be the best one for the following reasons:

- You cannot deduct actual costs sustained. There is a lump-sum deduction according to the coefficients;

- You need to add a € 2 stamp duty to each invoice issued if it exceed Euro 77,47.

- You cannot recover VAT on items you purchased.

- You cannot benefit from other tax reliefs scheme (e.g. the patent box reduced rate of tax on income from intellectual property).

- You waive all the potential tax deductible items, such as the family dependent tax credit, the house renovation credits, health expenses credits, and the Superbonus 110% which might potentially reduce your tax liability.

- You cannot opt for the new residents tax regime, waiving a potential 90% tax exemption on your income.

We therefore strongly advise to talk to a tax professional to assess your personal tax situation and evaluate carefully the best tax regime applicable to your personal case.

How can AccountingBolla help you?

Accounting Bolla is able to provide a full fledged accounting service to your needs, we will:

- support you in the evaluation of the best tax regime for you

- Set up your Partita IVA;

- Access to the first English based e-invoicing platform in Italy;

- File your annual tax return

Enquire below and setup your activity right now.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.