Almost every country in the world has an income tax which taxpayers have to pay on income they generate throughout the year. In Italy, such tax, is called IRPEF “Imposta sul Reddito delle Persone Fisiche”.

As the name suggests, IRPEF is levied on income generated by natural persons (individuals), as opposed to Corporate Tax “IRES” paid by corporation. Prior digging deeper into the IRPEF characteristics, it is important to understand who is required to pay such tax in Italy.

Generally speaking, if you are a tax resident of Italy you must pay IRPEF on your worldwide income; while if you are not a tax resident of Italy, you are bound to pay IRPEF on income generated in Italy exclusively (i.e. rentals, employment income, dividends from Italy). If you receive income from overseas, you must also check if such income source is taxable in Italy based on the double tax treaty. You can find a list of tax treaties here.

In any case, if you have also paid taxes in the foreign jurisdiction, you can offset it against Italian liabilities. This mechanism is called foreign tax credit.

The Italian income tax system is based on IRPEF (national tax), and two surcharges namely regional and municipal. This system allows local councils to increase or reduce taxation on their residente income. IRPEF is a progressive tax based on four brackets (five until 2021), therefore if you earn more money you pay more tax.

National, Regional and Municipal Income tax

- National Income Tax

The national income tax is based on four brackets, ranging from 23% to 43%, as per the chart below:

If you earned € 20,000 during a tax year, the first € 15,000 are taxed at 23% rate, whilst the following € 5,000 are taxed at 25% rate.

2. Regional Surcharge

The Regional surcharge is in addition to the national income tax and it is calculated on the same taxable income. Regional taxes vary from 0,9% to 1,4% of your income depending on the region.

3. Municipal Surcharge

The Municipal tax depends on the municipality in which you reside. It varies between 0,1 and 0,8% of your income.

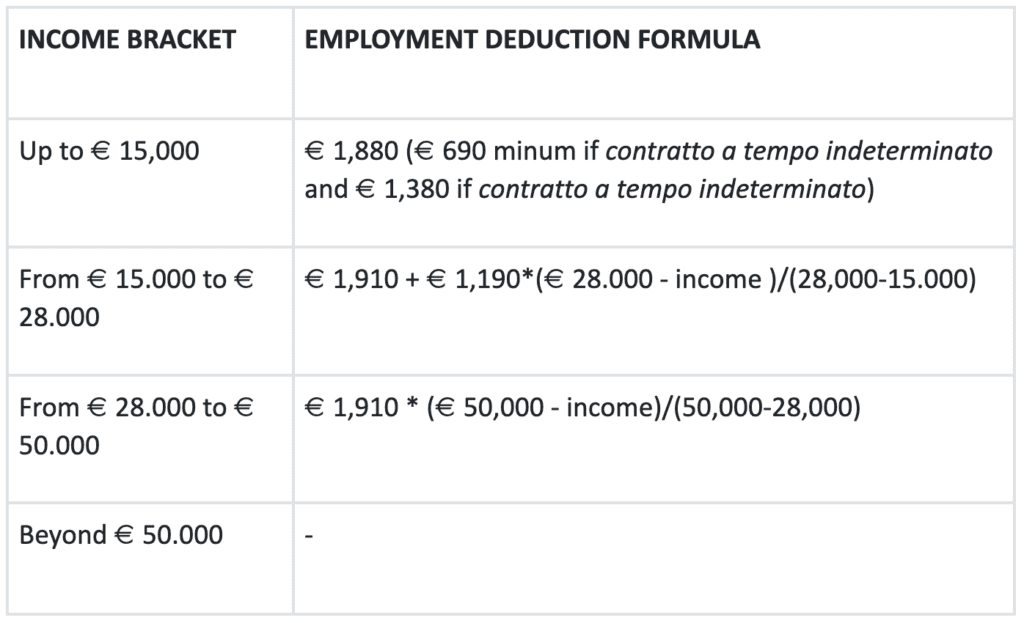

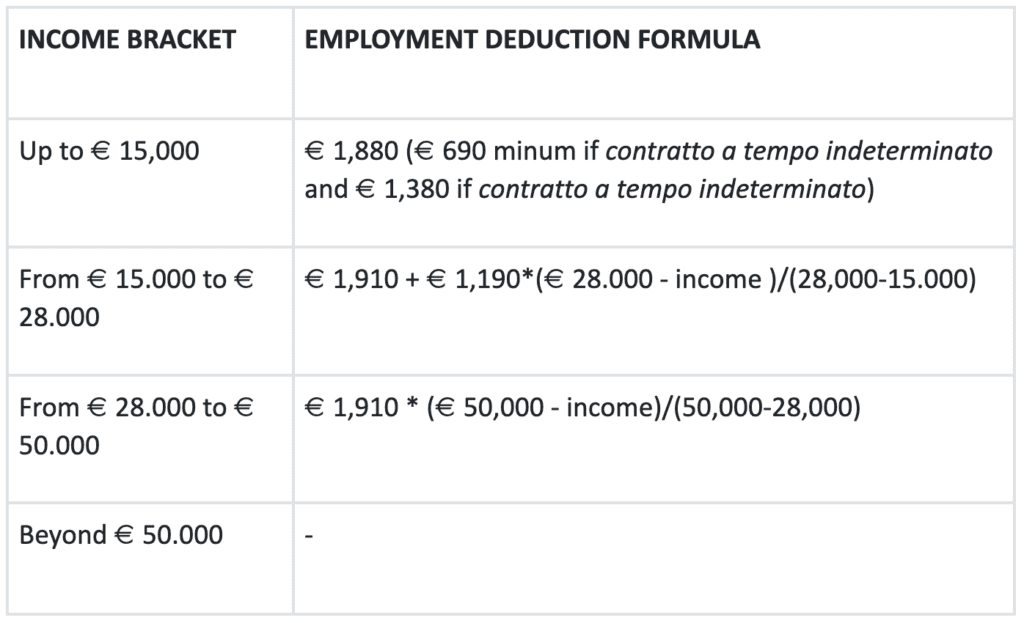

How do I calculate employment deductions?

The 2022 budget law has also changed the employment income deduction, amending art. 13 comma 1 lett a), b) e c) TUIR. If you calculate your taxation using the above chart, you end up calculating your gross tax; if you are employed, you need then to reduce it by the employment income deduction calculated as per the below chart:

There are no deductions if your income is in excess of € 50,000. The employment deduction has to be proportioned based on the number of days worked in Italy.

What can be considered as income generated in Italy?

These income sources are always defined as Italian based:

- Business income from an Italian resident company

- Pension sourced from Italy

- Income coming from Italian patent or trademark. In this case it should be paid by the Italian state or Italian residents.

- Italian sourced capital gains

- Income from an Italian employment contract, or freelancer’s activity

- Dividends paid by Italian institutions

- Interest paid by Italian residents

Is my foreign pension taxed in Italy?

If you are a foreign citizen living in Italy, your pension may not be taxable in Italy as per the applicable double taxation treaty with your home country.However, if you have Italian citizenship or you are planning to apply, then you are more likely to be subject to Italian taxation on such income source.

When is the tax deadline?

The general tax deadline is November 30th; however, if you had at least one employment income source during the previous year, you can file the mod. 730 which deadline is on September 30th.

Should you miss the November 30th deadline, you can still submit a late return within 90 days (up to February 28th of the following year) paying a small € 25 late submission penalty.

Failure to meet the ultimate deadline is a total disaster because you are then subject to a minimum fine of € 250 for late filing, on top of a variable fine ranging from 120% to 240% of any tax due, as well as a minimum fine calculated as 3% on your foreign held assets.

There are no amnesty procedures, nor mitigating factors. The best strategy at your disposal is to file on time!

When should you pay these taxes?

The general payment deadline is June 30th. You can extend the payment deadline to July 30th paying 0,4% surcharge.

If you are employed in Italy, you do not have other sources of income, and you do not claim any tax deductible item, you should not worry about filing your tax return since the PAYE system has already deducted your income tax monthly through your payslip.

If you switched job during the year, or you have received any unemployment benefit, you are required to file tax to adjust and settle any tax payable.

Otherwise, the tax office will write you a penalty letter adding unwanted fines and penalties.

Other taxes to consider

- Wealth tax on properties owned out of Italy

If you have real estate possession outside Italy you should pay a tax equivalent to the percentage of the property you own, and its size. The tax is called IVIE (Imposta sul valore degli immobili situati all’estero) and it is 0,76% of the cadastral value of the property.

In absence of such value, you can use the same value used for property tax purposes or the purchase price.

2. Wealth tax on financial investments owned out of Italy

Owning foreign based financial assets creates an obligation on the taxpayer to disclose such assets, as well as self assess any wealth tax (IVAFE) due. Generally speaking, any bank account is chargeable of a flat € 34 wealth tax, whilst the wealth tax applicable to brokerage and investment accounts amounts to 0.2% of the year end value.

On the other hand, private pension funds (i.e. 401k) do not attract any wealth tax; nonetheless, they must be reported to avoid unpleasant and unnecessary fines.

Crypto assets must be reported, and it’s likely you have to pay tax on ownership, and gains. Check this article about crypto taxation in Italy.

Note that if you hold financial assets through an Italian bank, the bank itself levies and pay such amounts; therefore IVAFE is not a tax to discourage foreign assets compared to local ones, but rather the same tax applicable to foreign items.

Both IVAFE and IVIE are paid in two installments: June 30th and November 30th.

Are there any tax breaks for qualifying expenses?

Italy has a very thorough list of items to be claimed in your tax return to reduce the IRPEF payable, such as:

- Health expenses;

- Education expenses;

- Kindergarten fees;

- University fees;

- House renovations;

- Rental contracts;

- Complimentary pension contributions;

- INPS payments;

- Rental paid;

- Mortgage interest on primary home purchase;

- Bonus mobili;

- Superbonus 110%;

- Foreign tax credits;

- Facade Bonus;

- Charity donations;

- Children sport expenses.

From 2022, you need to claim your child tax credit on the INPS website. INPS will pay the monthly tax credit directly in your bank account. Here my video explaining the whole process.

In addition to that, in 2019 Italy introduced a new tax exemption to attract retired people in Italy, which will guarantee you a 7% flat tax on any foreign income. With this and many more improvements, taxation in Italy is trying to become more competitive and appealing to foreigners.

How can AccountingBolla help you?

AccountingBolla can help you maintain your tax affairs in order. As a recognized tax agent, chartered with the Ordine dei Dottori Commercialisti, we can prepare and submit tax returns on your behalf.

We provide sound tax advice aimed at minimizing your tax burden in Italy, making the most efficient use of the tax system to give your wallet a break. What are you waiting for? Get in touch now.