The scheme for small taxpayers (described as the Regime dei Minimi as well as the Regime Forfeitaro) has seen a number of changes over the years and some of the old rules apply to people who started out in earlier years. But from FY 2016 there is only on regime open to new taxpayers – the Flat–Rate Scheme.

If they do not then they will be subject to tax on their net profit at the usual scale rates.

REQUIREMENTS

To benefit the following conditions must be met:

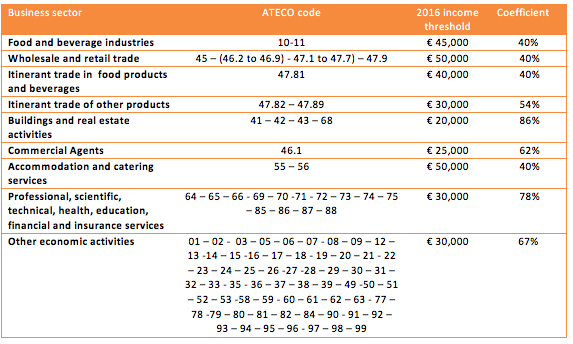

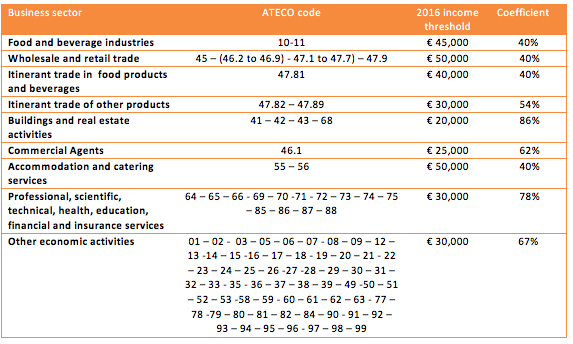

- The gross income (i.e. the amount invoiced to clients, not taxable profit after deduction of costs) must not exceed the threshold set for the category of activity to be carried on.

- Staff related costs must be below Euro 5,000;

- Deprecation of assets used in the business must not exceed Euro 20,000

- Individuals who are not resident in Italy must have at least 75% of their income from sources within Italy;

- Must not carry on business under any other special regime or under a special VAT regime (e.g. margin scheme of works of art second hand vehicles etc.);

- Must not carry on business of the purchase and sale of real estate, developable land and new vehicles;

- Must not be members of partnerships, professional associations nor must they be members of limited liability companies which have opted for the regime of imputation of taxable profits to the shareholders;

- Must not have received income from employment (and that includes pension income) in excess of Euro 30,000 in the previous year, unless the employment has terminated.

FLAT RATE TAXATION

The flat-rate scheme provides for income tax at the rate of 15% tax on gross turnover reduced by the coefficient in the table above.

If a self employed teacher will pay tax on 78% of gross earnings at a rate of 15% – an effective rate of 11.7% of gross income invoiced to clients.

The rate is reduced to 5% for a new business activity – defined as one being carried out for the first time and not an extension of a previous business carried out under the ordinary regime or a prior special scheme. This means an effective rate of tax of 3.9% of turnover.

Other Advantages are:

- No VAT needs to be charged on invoices issued and there is no VAT reporting/compliance – e.g. no annual VAT return etc.;

- Simplified bookkeeping – no need to register invoices and receipts, purchase and sales invoices in statutory registers;

- There is no need for clients to withhold tax on payments of fees – this represents

- Exemption from the “Spesometro” – the rules that work to stop excess tax deductions for costs in relation to gross income and the parameters deriving from industry sector studies.

- Exemption from sector study reporting;

- Exemption from reporting transactions with tax havens;

- Exemption from regional production tax (IRAP).

SOCIAL SECURITY

The new regime does not provide any reduction in the rate of contributions. Social security will be applied at normal rates to the gross income reduced by the coefficient.

Social security contributions are deducible from the taxable income on a paid basis – i.e. contributions on last year’s income are deductible from this year’s taxable base, after reduction of the coefficient.

POTENTIAL DISADVANTAGES OF THE REGIME

- You cannot deduct actual costs sustained. There is a lump-sum deduction according to the coefficients;

- You need to attach a 2 Euro stamp to each invoice issued if it exceed Euro 77,47. There is a way to do this online but it is administratively burdensome for people issuing only a few invoices a year.

- You cannot recover VAT on items your purchase . This means that the VAT on purchases of e.g. stationery, IT equipment, telecommunications etc. cannot be reclaimed and become a cost. That VAT is of course not deductible for tax purposes as there is a lump-sum deduction in the coefficient for expenses.

- You cannot claim deduction for expenses available for deduction (e.g. alimony, medical and vets bills, mortgage interest, and the various home improvement, energy refurbishment incentives) unless you have other income. This is because the flat-rate regime gives rise to a substitute tax and not IRPEF.

- You can benefit from other tax reliefs (e.g. the patent box reduced rate of tax on income from intellectual property). An important exception to this rule is the 20% tax credit for investment in fixed assets located or to be located in Italy’s Mezzogiorno.

IS THE FLAT RATE SCHEME FOR YOU?

Since you cannot deduct expenses the first thing to check is whether your tax deductible costs exceed the lump-sum deduction included in your applicable coefficient.

For many in the Italian gig economy, expenses on the whole will be limited. Given that many costs are anyway subject to statutory limitations (e.g. telephony/internet, training, vehicle costs), the flat-rate deduction will typically be more attractive.

The flat–rate scheme is therefore not appropriate for taxpayers with large cost structures, numerous employees, or who require premises or substantial plant and machinery to carry on their business.

In practical terms you should forecast the volume of turnover and expenditure to determine whether it is appropriate to apply the flat-rate scheme or stay within the ordinary system.

Another element to consider is the bureaucratic simplifications provided for by the flat-rate scheme: reduced bookkeeping and tax reporting requirements.

So for self-employed professionals, especially those starting up a new business for the first time the flat rate scheme will be attractive.

This scheme however does not make a lot of difference in social security terms. You should discuss with your customer/clients as to whether you can add on an extra 4% to your invoices to cover this, and if you are a citizen of a country other than Italy you should explore whether you are entitled to remain within your home country’s social security system, especially if you intend to remain in Italy for a short period.

Dear Nicolo Bolla,

I will be letting out my holiday home in Puglia via Airbnb and vrbo for the first time this year. It will be for short term letting.

I am thinking of setting it up as a business as the tax incentives for a new business seem alot more attractive than the flat 21% rate.

I understand you can deduct expenses like the cost of managing the property, cleaning, and other expenses this way too

I have read your article on this

Is it easy to set up a business for these purposes?

I am not an Italian resident. I am a resident of the UK.

I also do not speak Italian that well, so find it all quite confusing.

I would appreciate your advise of this matter

Many thanks,

Ben Tiramani

It is possible to do so, however you either need to be a resident or the foreign country you reside in needs to have a dual tax treaty in place. unless you let few properties, setting up as a business is not convenient

Thank you for the engaging content and the lively discussions in the comments section. It’s great to see a community come together like this.

This piece was enlightening. I’m grateful for the opportunity to learn from such a well-informed source.

I am an italian citizen

Living in the US for 30 years as a resident

I am planning to move back to Italy to take care of my elderly father. Starting in September, I will be receiving a pension from the US plus income from serving on a couple of border directors.

What do you suggest? Do I need to set up a new company in Italy and get paid as a consultant?

Would I still qualify for a 5% flat tax ?

You can qualify for 5% tax; however, if you move to the SOuth and you receive a pension, you can claim the 7% scheme