Freelancer Rights in Italy: What you need to know

Freelancing in Italy offers an attractive blend of autonomy, flexibility, and the chance to live la dolce vita. But before you pack your bags and set up your home office overlooking the Amalfi Coast, it’s crucial to understand the legal landscape and all the scope of freelancer rights in Italy.

Legal Requirements for Freelancing in Italy

First of all, it’s essential to address the legal aspects of freelancing in Italy. Before you start, you need to evaluate your workload. If your earnings from a single client do not exceed 5,000 euros per year, Prestazione Occasionale is a suitable option. However, it’s important to note that the work must be occasional and not ongoing. Additionally, to legally operate under Prestazione Occasionale, you must issue a “Ricevuta per Prestazione Occasionale” (Receipt for Occasional Services) to your client.

For those involved in long-term projects with higher income, obtaining a Partita IVA (VAT number) is necessary. The Partita IVA is essential for invoicing clients, paying taxes, and handling financial transactions related to your freelance work. You can apply for a Partita IVA online through the Italian Revenue Agency’s website or in person at your local Agenzia delle Entrate office. The application process requires you to provide personal information, details about your freelance activity, and proof of residence.

Your Freelance Rights – Know What You’re Entitled To

The story isn’t about obligations only, right? As a freelancer, you have freelancer rights, too, and knowing them can empower you to work confidently and protect your interests.

Fair Compensation

First of all, every worker—whether a freelancer, self-employed, or a full-time employee—has the right to fair and timely compensation for their work. To ensure this right is upheld, it’s crucial to sign a comprehensive contract that clearly defines all the details, such as payment terms, rates, deadlines, and invoicing procedures. This contract acts as a safeguard, protecting your freelancer rights to be paid fairly and on time.

Intellectual Property

As a freelancer, you retain ownership of your intellectual property unless you specifically transfer it to your customer in a contract. This means that any creative work you create, such as designs, writing, software code, or artwork, belongs to you until you agree otherwise. Make sure your contracts explicitly define intellectual property rights to avoid misunderstandings and safeguard your creative products.

Non-Discrimination

It is your right to work in an environment free of harassment and discrimination. Discrimination on the grounds of race, gender, religion, age, handicap, or sexual orientation is illegal in Italy. You have the right to seek legal counsel if you experience harassment or discrimination to resolve these problems and guarantee a fair working environment.

Dispute Resolution

Finally, disputes can occur in any kind of business relationship. Establishing a defined procedure for resolving disputes is crucial. Dispute resolution sections in freelancing contracts sometimes outline procedures like arbitration or mediation. To settle problems pleasantly and legally in Italy, you can also turn to labor unions or attorneys who focus on employment and freelance law.

Process and Timeline to Become a Freelancer

Now, let’s skip to the process. To have a freelancing business in Italy, you have to take into account several aspects like nationality, profession, etc. Yet, we brought a general overview of the steps involved and an estimated timeline:

- Visa and Residence Permit

If you are not an Italian citizen, obtaining the necessary employment visa and residence permit is a crucial first step in your journey to becoming a freelancer in Italy. The specific requirements and procedures will depend on your nationality and the nature of your freelance work in Italy. For non-EU citizens, this typically involves obtaining a nulla osta (clearance) from the local authorities, followed by applying for a self-employment visa at the Italian consulate in your home country.

| Category | Non-EU Citizens | EU Citizens |

| Visa | Self-employment / freelance visa required before entering Italy | Not required (freedom of movement) |

| Residence Permit | Apply within eight days of arrival. Usually valid for one year and renewable. | Register residence within three months of arrival |

| Application Process | Gather documentsSubmit to embassy/consulate3. Attend interview (if required)4. Receive decision | Gather documentsRegister residence with authorities |

- Obtain a Codice Fiscale and Register with the Italian Tax Agency and INPS

Now, it’s time to get your Codice Fiscale (your Italian tax code). You can apply for it at your local Agenzia delle Entrate (Italian Revenue Agency). European Union citizens can apply with their ID card, while non-EU citizens need their passport and residence permit (or application receipt). If you don’t currently reside in Italy, you will complete this step after securing a visa.

After successfully getting codice fiscale, you have to register your business structure and only then have the right to start a business/work. You have to decide whether you will operate as a “libero professionista” (freelancer) or “ditta individuale” (sole proprietorship).

As “libero professionista” (freelancer), you’ll typically need to submit a “Dichiarazione di inizio attività” (Declaration of Start of Activity) using the appropriate form (e.g., Modello AA9/12) to your local Agenzia delle Entrate office. You may also need to register for VAT if your earnings exceed a certain threshold.

You will also need to register with the Istituto Nazionale della Previdenza Sociale (INPS) for social security contributions based on your income. Social security contributions provide you with benefits like healthcare, pensions, and maternity/paternity leave.

- Obtain a Partita IVA (VAT Number) and Open a Bank Account

Finally, you have to obtain our unique identification number required for issuing invoices and paying VAT. It can be done online through the Agenzia delle Entrate website or with help from a commercialista (accountant). You’ll need your Codice Fiscale, ID, and business activity details. It typically takes a few days.

And of course, you have to open a bank account. It’s essential for managing finances, receiving payments, and paying taxes.

Note: Depending on your profession and the nature of your business, you might also need to register with the Chamber of Commerce. This is usually required for freelancers who are considered “artigiani” (artisans) or “commercianti” (traders), offering services or products in specific sectors.

Tax Rates for Freelancers in Italy

| Tax Regimes | Description | Tax Rate | Eligibility Requirements | Restrictions |

| Standard Income Tax (Regime Ordinario) | Progressive tax rates based on income brackets. | 23% (up to €28,000) <br> 35% (€28,001-€55,000) <br> 43% (€55,001 and above) | No specific income limits. | Higher tax rates for higher earners. |

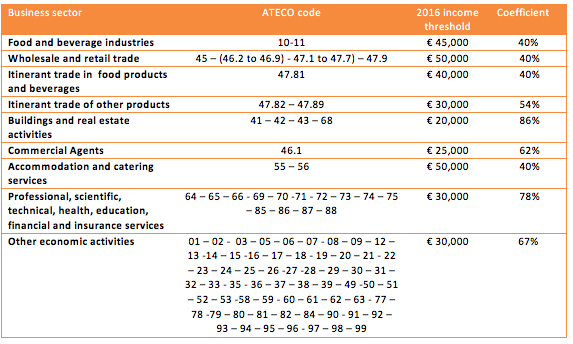

| Flat Rate Tax (Regime Forfettario) | Simplified regime for new businesses and freelancers with lower incomes. | 5% for the first five years, then 15%. Varies by profession based on ATECO code (e.g., 78% of earnings taxed for financial services). | Must not exceed €85,000 in annual revenue. Specific conditions may apply based on profession and business activity. | Cannot offset business expenses. Limited to certain regulated professions and income levels. |

| New Residents Tax Regime | Applies to individuals who have not been tax residents in Italy for the previous two years. | 70% or 90% tax exemption on income for the first five years (depending on the region). | Must not have been a tax resident in Italy for the previous two years. |

Key takeaways…

Freelancing in Italy provides an appealing lifestyle and rewarding opportunities, but navigating the legal landscape and recognizing your freelancer rights is critical. You can build the framework for successful freelancing employment by completing the essential legal requirements, such as obtaining a Partita IVA, registering with INPS, and obtaining any necessary permits.

Remember, as a freelancer, you are entitled to fair wages, intellectual property protection, and a non-discriminatory environment. Familiarize yourself with the rights and resources accessible to you in the event of a dispute.

Are you interested with similar subjects? Take a look at our related articles here: Italian freelancer visa: a step by step guide for self empoyed and enterpreneurs, Health Insurance for Foreigners in Italy: A Complete 2024 Guide and Freelancing in Italy: Pros & Cons in 2024.