Affiliate marketing is one of the tools most used by marketers to earn online. After analyzing the levers on which to focus to get profits, I face the taxation system. If you want to understand how many people earn money through affiliations, don’t miss this guide.

Making money from affiliate marketing is still possible.

Affiliate marketing is a marketing tool. With it, many companies that sell goods or services make use of external affiliate websites. All for the promotion of their sales network.

The websites, in return, get a commission. This is a fee that varies as a percentage of sales obtained by the principal company.

In recent years, affiliations have seen a significant increase. This is also thanks to the ease of use of this tool by many websites and blog managers.

In practice, through the affiliate network, manufacturers can increase their sales network.

Below I will analyze how this particular type of marketing works and what are the potential gains that can be obtained. Of course, taking care to deal also with its tax implications.

Affiliate marketing

Affiliate marketing, also known by the term “affiliation,” is a particular marketing strategy related to the internet world.

It is a reasonably simple strategy in principle. It has developed a lot, though, especially in the last seven years.

Three parties are involved in this type of marketing strategy:

- Retailer. The company that has products or services to promote in the market, which uses the webmaster to promote its sales network;

- Webmaster. Website operator, who uses the affiliation with the retailer, to promote products or services through unique articles or special banners on the website;

- The customer. The final customer buys the product or service by clicking on the affiliate link on the webmaster‘s website.

The commission system

The retailer pays the webmaster a percentage (usually from 10% to 30%) on the price of the product or service.

Monthly is made a report of sales made. Then, when certain thresholds of commissions are exceeded, payment is made (by bank transfer or Paypal).

Affiliate marketing campaigns are more complex than other methodologies. I’m thinking, for example, of the banner ads that many bloggers host on their sites.

Online advertising is based on a simple concept; there is a fee for every click of the user. Of course, this compensation is very low. To get actual earnings, you have to be a real portal updated daily and with millions of readers.

Affiliate marketing has a more complex mechanism. In addition to the user’s first click, there must be the sale of a product within a certain period. The user, therefore, is asked to buy a product after visiting a specific web page.

In this case, the profit is more consistent and evaluated as a percentage of the product sold.

A unique feature of affiliate marketing is that, unlike the relationship between wholesalers and retailers, the affiliate webmaster has no obligation whatsoever to the retailer.

If the webmaster generates sales, all parties profit, whose percentages are established at the beginning of the relationship.

Affiliate marketing has become popular precisely because the affiliate enjoys maximum freedom in choosing the products or services to promote, the time to devote, and the strategies to follow.

Affiliate Offers

It’s the affiliate offers.

These offers can be found on specialized sites that allow users, after registration, to publish on their sites the various links to the products or services they market.

To make the most of an affiliate campaign, it is necessary to keep in mind some essential elements. First of all, the reliability of the retailer company.

To verify the seriousness of these companies, just compare the commissions they offer compared to those of the market. But above all, go and read the opinions of affiliates posted in the various forums that deal with these topics.

Paid advertising

Paid advertising is the most effective digital marketing discipline for quickly acquiring visitors in a targeted, measurable and precise manner.

They are part of paid advertising:

- Google Adwords,

- Google Shopping,

- Facebook Ads,

- Twitter Ads,

- Linkedin Ads,

- Instagram ads, comparators, and affiliations.

In practice, paid advertising is nothing more than the set of marketing strategies related to the paid promotion of products or services.

Through the correct use of these tools, the webmaster can bring paid visits to their site.

In the language of the web, having visitors, and therefore “traffic,” is the element at the base of any advertising campaign, such as the same affiliations.

Therefore, this equation can bring significant results in terms of earnings for the webmaster if adequately exploited.

Not everything is that simple, however. Knowing how to act on the levers of this equation is not simple. You have to know how to handle and know well the web, SEO, social media marketing. Topics that, notoriously, are not for everyone. Knowing them requires experience and in-depth technical knowledge.

Affiliate marketing taxation in Italy

Let’s now move on to analyze the tax discipline related to earnings from affiliate marketing activities.

First of all, you must audit each single affiliation contract (contractual conditions, duration and number of websites used, etc.). There is no tax discipline valid for all types of affiliations currently in use.

The activity of affiliate marketing has characteristics similar to procuring business from agents (linked to commissions) and the commercial activity related to advertising services.

For this reason, the analysis of the contract can only be the starting point for the study of the tax regime to be applied to the earnings from this activity on the web.

How to manage earnings from affiliate marketing for tax purposes?

VAT number is a compulsory requirement when carrying out economic activity on a regular basis.

The Internal Revenue Service considers this activity to be habitual (with rare exceptions). This is because affiliate campaigns generally have a constant duration over time.

For this reason, the Agency necessarily requires the opening of a VAT number to declare the earnings from commercial affiliate programs.

However, for webmasters who are at the beginning of their activity (in the first year of commercial activity) and if the amount of earnings obtained is tiny (a few hundred euros per year), it is possible to opt, at least for the first year, for occasional self-employment services. To declare these earnings, it will be sufficient to prepare a receipt for the occasional self-employment activity issued to the company that paid the compensation. Moreover, if the company that paid the income is foreign, the withholding tax will not have to be indicated.

The receipt will then be used to declare these earnings in the R.L. section in the P.F. Modello Redditi. The model contains the income category of “miscellaneous income.”

It’s the same thing if we fill out the 730 form instead.

This solution, which seems acceptable because with earnings so small would not be bearable, the cost of management of a VAT number, may not put you away from any disputes by the Revenue Agency in case of assessment.

Opening a VAT number for affiliate marketing

Operating with a VAT number is necessary when:

- Gains made are substantial;

- The activity has already started for some time (you are in your second year).

In short, in all cases where the activity becomes habitual and continuous over time, a VAT number is mandatory. Upon requesting a VAT number, you must report your earnings through invoices, and file an annual tax return.

By issuing an invoice, you will certify the remuneration received for your affiliate activity. In practice, you will be authorizing the fee received on your current account for the move.

Please note that you must pay particular attention if the invoice is in the name of a foreign person. If the company you are working with for the affiliation is not based in Italy, you will have to issue a foreign invoice.

You must also remember that if the ordering company is based in one of the E.U. countries, it is mandatory to submit Intrastat lists.

Tax return for affiliate marketers in Italy

You must report your earnings in your tax return regardless of their source:

- Occasional self-employment

- Professionally through the VAT number.

If you operate with a VAT number, you must fill in the appropriate box regarding the tax regime you belong to.

It would help if you remembered that, in any case, affiliate marketing earnings must be subject to direct taxes.

Forfeiture regime in affiliate marketing

The leading solution to manage earnings from affiliate marketing is the Regime Forfettario.

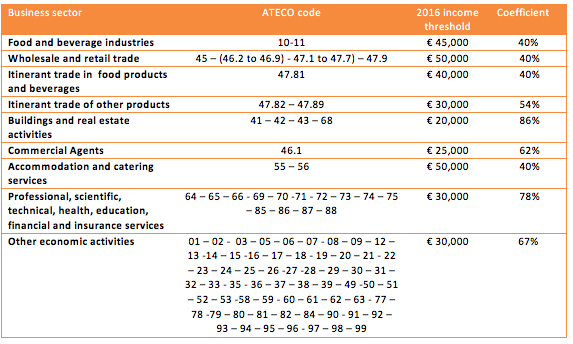

This is a simplified tax regime, a natural regime for individual VAT numbers. The rule provides for a maximum turnover of € 65,000, and the 40% profitability coefficient applies.

Suppose you consider that you are going to tax at a rate of 5% of the income thus generated; the advantage increases. After the first five years, the rate rises to 15%.

With this tax regime, you will be able to manage the earnings from this activity optimally. All this without counting that you will avoid the application of VAT, IRAP, and Electronic Invoicing.