Digital Nomads embrace the lifestyle of Live anywhere, work anywhere. Basically, as a digital nomad, you work remotely for a business located anywhere in the world and you have the personal freedom of moving in different countries and cities, repudiating the 9-5 lifestyle. Considering that the world after Covid-19 is affected by the great resignation, and the refusal of various elements of the workforce to return to their office routines, it is

There are only two obstacles on your path to fulfill your digital nomad life:

- Immigration

- Taxes

Albeit you have the freedom to move anywhere, any digital nomad has a base somewhere to pay taxes. Maybe it is your country of origin, or your most recent country of residency, or you may pick a Dubai, Lisbon, and Bangkok have proved as effective destination for digital nomads worldwide, combining a great lifestyle, low taxes, and great transportation connection.

How many times have you dreamed of living your life in Italy and working remotely from here? I bet you were pulled back by its high taxes and hard to fit bureaucracy. Furthermore, immigration was very difficult and as non-EU citizen you could only rely on your tourist VISA without the possibility of settling to Italy long term.

The Italian Digital Nomads VISA draft law

The draft law n. 2505 introduces new amendments to the immigration code art. 27 introducing the letter q-bis) adding non EU citizen digital nomads and remote workers as qualifying categories for this VISA.

Note that there is no entry quota for categories listed in art. 27, therefore you can enter Italy with your VISA regardless of the number of applicants worldwide.

Art. 6-quinquies. – (Ingresso in Italia per lavoro dei nomadi digitali e lavoratori da remoto) – 1. All’articolo 27 del testo unico delle disposizioni concernenti la disciplina dell’immigrazione e norme sulla condizione dello straniero, di cui al decreto legislativo 25 luglio 1998, n. 286, sono apportate le seguenti modificazioni:

a) al comma 1, dopo la lettera q) è inserita la seguente:

“q-bis) nomadi digitali e lavoratori da remoto, non appartenenti all’Unione europea”;

b) dopo il comma 1-quinquies è inserito il seguente:

“1-sexies. I soggetti di cui al comma 1, lettera q-bis), sono cittadini di un Paese terzo che svolgono attività lavorativa altamente qualificata attraverso l’utilizzo di strumenti tecnologici che consentono di lavorare da remoto, in via autonoma ovvero per un’impresa anche non residente nel territorio dello Stato italiano. Per tali soggetti, nel caso in cui svolgano l’attività in Italia, non è richiesto il nulla osta al lavoro e il permesso di soggiorno, previa acquisizione del visto d’ingresso, è rilasciato per un periodo non superiore a un anno, a condizione che il titolare abbia la disponibilità di un’assicurazione sanitaria, a copertura di tutti i rischi nel territorio nazionale, e che siano rispettate le disposizioni di carattere fiscale e contributivo vigenti nell’ordinamento nazionale. Con decreto del Ministro dell’interno, di concerto con il Ministro degli affari esteri e della cooperazione internazionale, con il Ministro del turismo e con il Ministro del lavoro e delle politiche sociali, da adottare entro trenta giorni dalla data di entrata in vigore della presente disposizione, sono definiti le modalità e i requisiti per il rilascio del permesso di soggiorno ai nomadi digitali, ivi comprese le categorie di lavoratori altamente qualificati che possono beneficiare del permesso, i limiti minimi di reddito del richiedente nonché le modalità necessarie per la verifica dell’attività lavorativa da svolgere” ».

Italian Digital Nomads VISA requirements

The Digital Nomads VISA requirements appear quite easy to meet, you must:

- Currently run a freelance business

- Have a qualifying health coverage

You don’t need any Nulla Osta from the Italian authorities, and the whole procedure can be done at the foreign Italian consulate with no need of any clearance certificate from any Italian authorities (tax office, Chamber of Commerce, Labor department etc.).

This VISA lasts one year and it is renewable each year, providing you have sufficient income sources; after 5 years you can claim the EU permanent residency allowing you the same freedom of movement as any EU citizen. At the moment, the draft law, authorizes few Italian Minister’s department to issue a decree within 30 days from the law’s approval defining:

- The Digital Nomads VISA process;

- The applicant’s requirements (including worker’s categories who can access it);

- Minimum income requirements to apply;

- The immigration department audit powers.

From this draft law, it is apparent the Italian government intent to attract new professionals to Italy, and therefore the admission process should be quite straightforward.

What to do once you arrive to Italy on your Digital Nomads VISA.

Within 8 days from your arrival to Italy you must request an appointment at the immigration office, and in order to do so you have to book it at a local post office; note that Post offices displaying the “Sportello Amico” badge are authorized to book immigration appointment. I advise you to check this before hand, and to avoid any long queue you can book the post office meeting downloading the Ufficio Postale app. This will save you a lot of time!

At the post office you must submit all the relevant documents you file to the foreign consulate, as well as a copy of your passport stamp certifying the entry date to Italy. Once the documentation is complete you will receive a receipt which works as a Temporary Permesso di Soggiorno Card until the day you show up at the immigration office.

On the immigration office appointment day you must provide your fingerprints, and they will check your application. If everything is alright, you will receive a pickup date of your Permesso di Soggiorno and your immigration journey is finally over.

How setup your Digital Nomads business in Italy?

In the meantime, you can setup legally to become a freelancer in Italy, and the process is very straightforward as you need to get the Partita IVA, as well as register at the Social Security Administration (INPS). This procedure can be done directly at the Agenzia delle Entrate office, you can apply online from your Cassetto Fiscale, or you can ask a certified accountant like us to do it on your behalf. You can get your Partita IVA in less than 24 hours!

Check out how INPS works in Italy. Note that American citizens don’t have to pay any Social Security to Italy as they can remain covered under the US Social Security treaty of coverage in effect between Italy and the USA.

Why is Italy becoming the new to go destination for Digital Nomads?

Digital nomads tend to choose their next place of destination based on the following factors:

- Quality internet connection

- Relatively low cost of living

- Ample availability of coworking spaces and laptop-friendly cafes

- Easy immigration

- Attractive taxation

- Airport connections

Now that hard immigration is no longer an excuse given the brand new Italian Digital Nomads VISA, taxes are the main obstacle for Digital Nomads to move to Italy. This couldn’t be more wrong!

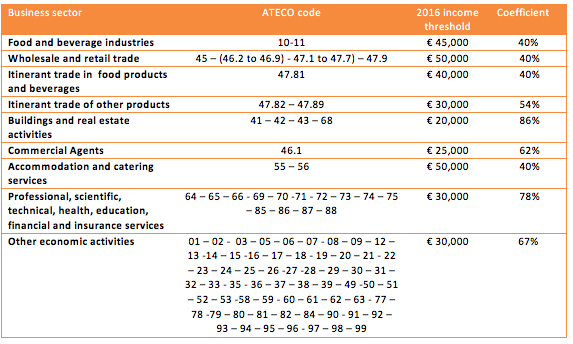

As a new comer of Italy you can basically pick between two very attractive regimes:

The Regime Forfettario allows you to pay a flat 5% tax on your earnings, while the new residents regime allows for a reduction of your taxable income between 70% and 90%! If you are a new resident in Sicily and you make € 100,000 in taxes you won’t pay a single € in taxes.

Don’t believe this? Check out our tax calculator and simulate how much taxes you will pay once in Italy.

If you are interested in this VISA, feel free to drop us a line.

Accounting Bolla is the Italian leading Taxes and Immigration firm that can help you remotely.

Get in touch with us now using the form below!

Hello,

Is it possible to have a call to ask questions on the above?

Thank you

Please use the form to send us an email!

Hello

I need help in applying for the eco-bonus as I am in the process of buying a property. I would also be interested in the Digital Nomad visa

Dear Nick,

can you please use the form below to contact us?

Does a remote worker qualify for the digital nomad visa and does his employer need to be registered or file returns in Italy?

Has Italy set the process and requirements for the Digital Nomad VISA?