It is divided into three levels (national, regional and municipal) and it varies according to the time you spend in Italy, your income, and your revenue sources.

In the first case, to avoid double taxation, we suggest also to check out the list of bilateral agreements regarding income tax rate, between Italy and your home country.

National, Regional and Municipal Income tax

- National Income Tax

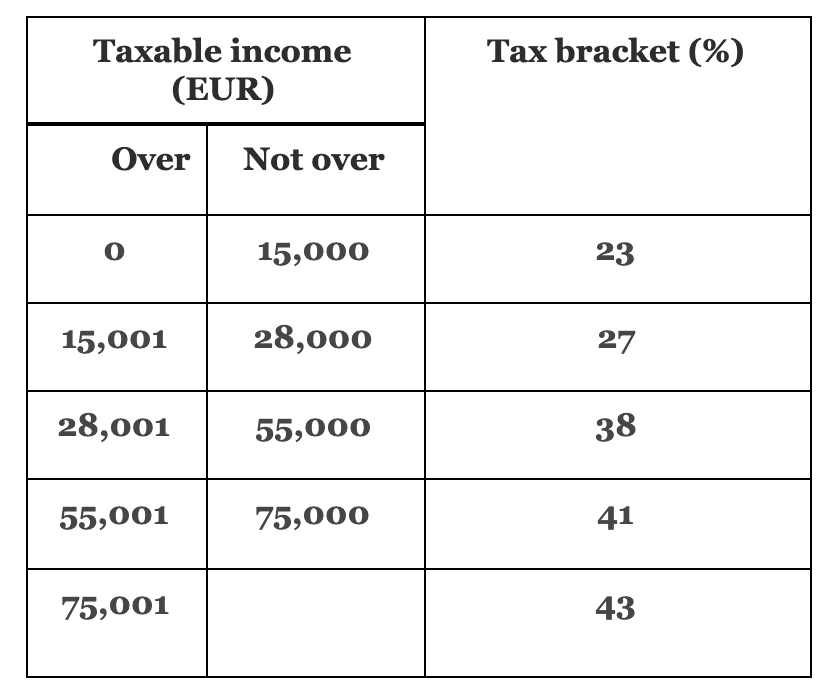

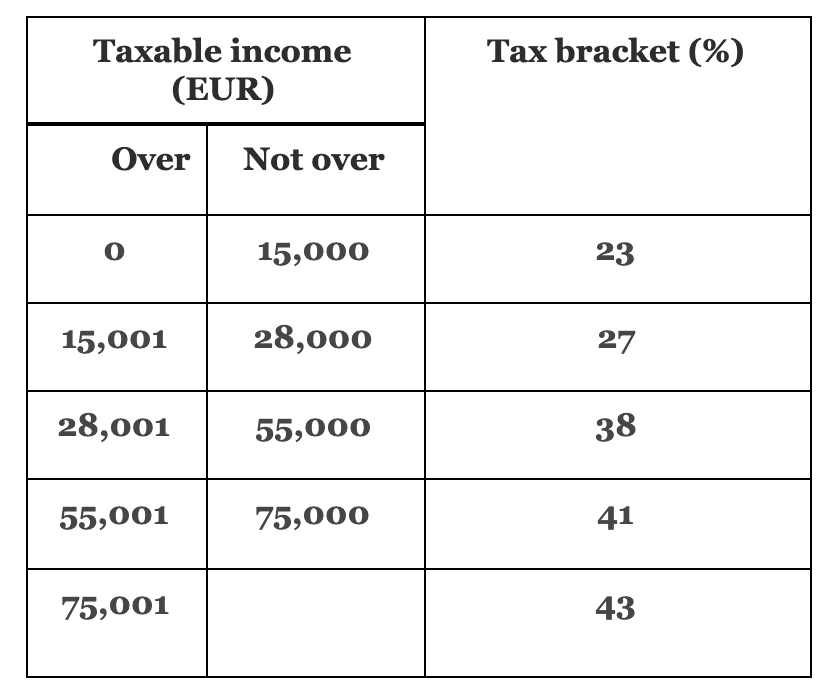

The national income tax is the core one, ranging from 23% to 43% of your taxable income.

Income taxes in Italy are progressive meaning that taxes will increase the more you earn.

1. If your income is less than € 15,000 you are subject to 23% IRPEF.

2. If your income is in excess of € 15,000 but less than € 28,000 you are subject to 25% of IRPEF.

3. If your income is in excess of € 28,001 but less than € 50,000 you are subject to 35% of IRPEF.

5. If your income is in excess of € 50,000 you are subject to 43% of IRPEF.

All the data summed up in the table below.

source: tradingeconomics.com

Regional surcharge is in addition to the national income tax and it is calculated on the same taxable income. Regional taxes vary from 0,9% to 1,4% of your income depending on the region.

The Municipal tax depends on the municipality in which you reside. It varies between 0,1 and 0,8% of your income.

What can be considered as income generated in Italy?

- Business income from a resident company in Italy

- Pension sourced from Italy

- Income coming from Italian patent or trademark. In this case it should be paid by the Italian state or Italian residents.

- Italian financial income and capital gains

- Income from an Italian employment contract, or freelancer’s activity (check out our article regarding freelancer taxes in Italy)

Is my pension taxed?

When is the tax deadline?

The general tax deadline is November 30th, which is anticipated to June 30th if you file your paper return at the tax office. Should you opt for the 730 filing, which guarantees a faster tax refund, the filing deadline is set on September 30th.

If you miss the November 30th deadline, you can submit a late filing within 90 days (up to February 28th of the following year) paying a small € 25 late submission penalty. Failure to meet the ultimate deadline is a total disaster because you are then subject to a minimum fine of € 250 for late filing, on top of a variable fine ranging from 120% to 240% of any tax due, as well as a minimum fine calculated as 3% on your foreign held assets.

There are no amnesty procedures, nor mitigating factors. The best strategy at your disposal is to file on time!

When should you pay these taxes?

Paying taxes as an employee in Italy

If you are employed in Italy, you do not have other sources of income, and you do not claim any tax deductible item, you should not worry about filing your tax return since the PAYE system has already deducted your income tax monthly through your payslip.

Other taxes to consider

- Wealth tax on properties owned out of Italy

If you have real estate possession outside Italy you should pay a tax equivalent to the percentage of the property you own, and its size. The tax is called IVIE (Imposta sul valore degli immobili situati all’estero) and it is 0,76% of the cadastral value of the property, but it can vary according to the type of property (luxury or normal) and its destination of usage (commercial, residential, agricultural…).

IVIE is assessed on the same value used for property tax purposes in the foreign jurisdiction; furtheremo

2. Wealth tax on financial investments owned out of Italy

Also, this wealth tax is proportionate to the percentage owned and the size of the asset. This is called IVAFE, which stands for “Imposta sul valore delle attività finanziarie detenute all’estero”. In general, this is 0,2% of the value of the asset.

Bank accounts are subject to fixed € 34 wealth tax, regardless of the amount at year end, whilst private foreign pension funds (i.e. 401k) funds do not attract wealth tax.

Cryptos have to be disclosed in the form, however, generally, there is no wealth tax to pay.

Both IVAFE and IVIE must be paid in two installments: June 30th and November 30th.

Are there any tax breaks?

- For instance, if you earn less than 8K per year as a regular employee this tax is not due.

- If you are 75 or younger, and you earn 7500 € per year you should not pay IRPEF.

- If you are 75 or older, and you earn 7750 € per year you should not pay it as well.

In addition to this there are various expenses that

- Health expenses;

- Education expenses;

- Kindergarten fees;

- University fees;

- House renovations;

- Facade Bonus;

- Complimentary pension contributions;

- INPS payments;

- Rental paid;

- Mortgage interest on primary home purchase;

- Bonus mobili;

- Superbonus 110%;

- Foreign tax credits;

Since 2022, you need to claim your child tax credit directly through the INPS website which will deposit the monthly tax credit directly in your bank account. Here I made a video explaining the whole process.

Furthermore, from 2019 Italy has also introduced a new tax exemption to attract retired people in Italy, which will guarantee you a 7% flat tax on any foreign income. With this and many more improvements, taxation in Italy is trying to become more competitive and appealing to foreigners.

Final considerations

Furthermore, there may be many exemptions and deductions you have not considered or there might be conflicts between the Italian tax system and your home country one..

To be sure, we strongly suggest you check out your numbers with an international accountant in Italy, to be 100% law compliant.

In addition, check out our video below, about essential tips and suggestions to pay taxes in Italy.

Want to read more? Check out also our articles about filing your taxes in Italy, or airbnb taxes in Italy, or our guide for retiring in Italy.

I am scottish living in italy. I have residency and pay all my taxes due on my pension to the uk.

I am now being asked to start paying italian taxes from 2015 with an added interest rate and fine for not having paid them. Could u check your info on your site please

Dear Christine, I am happy to help you regarding the tax office request. Can you please fill the form below and get in touch with us?

great article. how about interest earned from bank accounts overseas and dividends received from foreign companies? how are those taxed?

There are two tax options. The first one is flat 26%, the other one is the regular IRPEF tax rates

Good morning, my boyfriend and I are finishing our PhD degrees now in Italy. He (italian) is still claimed as part of the nucleare family and his parents write some expenses off for him. He’s never filed his own taxes of course, his stipend is his first paycheck. We are discussing marriage. I’m American and have been indipendent from my parents for tax purposes for many many years. Taxes there are less complex I think, I’ve filed or myself always. We wonder how marriage changes the financial picture for couples and families here. In the states, it’s typically advantagious for the couple financially to file as married, less for parents but the parents and family are usually out of the picture finacially long before anyhow. If his parents lose money when we marry, maybe we would time our plans differently, put it off longer. Do you know how marriage impacts families and individuals tax wise? Thank you!

I have dual citizenship of the US and another EU country and I will be studying in Italy for the next 5-6 years. I am looking to open an Etsy shop and was wondering if you would be able to provide some guidance as to what this entails tax-wise. I have declared my residence in Italy already since I am an EU citizen. Thank you.

Happy to help with your Etsy shop. Can you please write us an email with your request?

Hi Nicolo,

Great post – thanks for sharing. If self-employed freelancer, is it possible to deduct education and expenses to reduce your taxable income, like in the US? Thanks!

Hello, thanks for this post. I am a non-italian foreigner resident in France, employed by an italian company as remote worker, would you know whether I am subject to the same progressive national income tax ranging from 23% to 43%, or a different taxation?

Thank you in advance.

Hello. I am from the UK but now live in Italy. I retired early and have a pension of around 9000 euros per year. do I pay tax on all of it or just what’s over the 7500. In uk I would not pay tax as below the tax free allowance

You are required to pay tax on it, and you can benefit of pension tax deductions on it to reduce your taxable income and subsequently your tax expenditure

How are withdrawals from a 401 k (US) treated in Italy for income tax purposes? Likewise what about the total value of the 401k. I am a dual citizen (US/It) with recently obtained residency in Italy in Sept, 2021.

Any 401k withdrawal is deemed as pension income source, thus taxed at IRPEF progressive tax brackets

If the 401K withdrawal was made while the dual citizen is in Italy for less than half a year from August to December, but then the citizen remains continuously for another less than half year from January to May, would the continuity of more than 183 days spread over a year end and year beginning cause the Italian tax to be applied?

In that case you are not considered a tax resident because you must spend the most part of the tax year (January to December) in Italy to pay tax on your worldwide income

Are funds earned outside Italy by a deceased non-Italian citizen and deposited by his non-Italian heirs into an offshore account of an Italian bank taxable upon being deposited, and if so, at what rate? Neither the deceased nor the heirs had ever lived in Italy. Can the deposited funds be used to pay the inheritance tax, if any? Gratefully :):):)

was the deceased resident of Italy?

Hello Nicolo. Thanks for the article! I’m a wife of a diplomatic worker who’s going to stay in Italy two more years and started an ecommerce. I’m not selling in Italy. I’m selling in the US. Am I supposed to pay any taxes in Italy? Thanks in advance!

yes you are!

I am thinking of staying in Italy for less than 183 days per year and live the rest of the time in my home country. If I am working remotely for a company in my home country whilst in italy and pay tax on my income in my home country, would I need to pay any tax in italy?

Thanks

If you don’t trigger tax residency in Italy, there is no need to disclose your income and pay tax to Italy

Hello Nicolò,

I am a Vietnamese national living in Italy under a student stay permit. I am working remotely on a freelance basis (without employment contract) for a company in the UK. I’m earning on an average of 600-700 euros per month. Am I required to pay Italian tax? At which rate will my income be taxable?

Thank you so much.

you should setup in the regime forfettario and pay roughly 25% in social security and taxes

Hi hope you’re fine. I am working in restaurant but this year first 4 months I didn’t worked. Now if i work 8 months this year and my income is €10000 in 8 months. How much my boss have to pay tax?? Means how much tax will be ??? Please reply thanks

it should be less than € 1000

I moved in Italy last 2021 (January) and now working with a multinational bank with a permanent contract for almost 16 months. Am I subject to Special Tax Regime for income tax in Italy since the bank I am working with now is the same bank I’m working in the Philippines. However, I ended my contract there and started a new contract here in Italy as locally hired? Thank you.

yes you can claim the new residents regime. you are still on time to claim the 2021 tax return

I am a EU Belgian seafarer who is interested in moving to Italy , my employer/contracts are Bahamas based since this were the company /ships are registered . I am most of the times at sea and would be less than 183 days in the country . I was advised that my worldwide income would be` exempt as I was advised the below ruling would should be applied : is this correct ?

The Revenue Agency confirms the exemption of income derived abroad by foreign maritime employees who are tax residents of Italy

The Italian Revenue Agency has recently issued a ruling (No. 134/2020) clarifying that the income derived by a Spanish citizen (and Italian-tax resident) maritime employee working aboard a ship flying a non-Italian flag for more than 183 days in a 12-month period is excluded from tax in Italy.

The ruling is interesting as it is one of the few cases where the domestic law of a country appears to discriminate taxpayers on the basis of their nationality (not tax residence).

that’s correct. there are also standard remunerations (much lower than ongoing values) that can greatly reduce your taxation.

Feel free to contact us over this

Hallo. We are Czech citizens living and working in the Czech Republic. We own an appartment in a skiing area in Italy. It is rented for short-time rents through an Italian agency, which pays already the taxes from the income. We have no other income or any other interests in Italy. Do we have to submit the tax declaration in Italy? if so, is it any possibility for foreigners to submit it online?

Thank you for your answer.

No if you don’t have any tax deductible item to claim. Furthermore, are you up to date with your IMU (property tax)?

My husband and I currently live in Italy. He was employed here in August 2021. His taxes have always been deducted from his payslip so he doesn’t have any tax default. But we want to leave Italy now. I want to find out if leaving Italy been less than two years that we arrived in Italy, will create a tax liability for him. Can he de-register and we leave without any tax implications?

likely to, if he gets PAYE deducted from his monthly payslip

I am a Greek citizen and my fiscal resident is in Greece where I declare my worldwide incomes. My incomes are from divident as a shareholder of a company who operate in Cypro. Recently I moved in Italy and have been a resident. It is required to declare and in Italy my incomes for tax perpuse, desperate the fact that I will not change my fiscal resident that is my country of origin Greece.

if you reside full time in Italy; it’s likely you have also transferred your worldwide income place of taxation to Italy; therefore you are required to disclose and pay tax on your foreign income sources

Hi, I’ve been living in the UK for 7 years and now I’m starting a new job in Italy in October (new employer), I’m also moving there with my family because my job will be based there and no longer in the UK. My question is if I’ll have to pay income tax in Italy considering the fiscal year ends in Italy by 31st December 2023 and I’ll be only 90 days as resident. Do I have to pay something in the UK related to this income in Italy?. Thank you

for 2023 your tax will be deducted at source, with no further obligation. You may apply the split year in the UK thus waiving any UK taxation on your Italian income

Hi Nicolò,

I hope you are well, I have a questions if I am a UK resident with EU passport about to work on a boat in Italy with Italian flag , I can keep paying my taxes in UK or I have to pay taxes in Italy as well? Thank you in advance.

depends on the type of boat, and if your chartered company has a base in Italy or not