Italian real estate sector has boomed in the past years due to the rise of airlines coming to Italy, the decrease in travel prices, and a railway system that has been improved a lot in the last decade making traveling through cities fast and affordable.

Here in this article you can find useful tips and suggestions of what you can expect when buying and maintaining a house in Italy.

Buying a house in Italy: which taxes should you pay?

We will list them here for you.

1. Stamp Duty

If you are buying from a private person you do not pay any VAT.

In addition if this property is your primary residence in Italy and you spend here more than 6 months per year, the tax will only be 2% of the cadastral value.

On the other hand, if this is your second property and you are not a permanent resident this tax rises up to 9% of the cadastral value.

In case the purchase has been provided by a registered company in Italy the tax will only amount to 200€.

You also have the option to declare to the Revenue Agency that you will become resident within 18 months from the purchase.

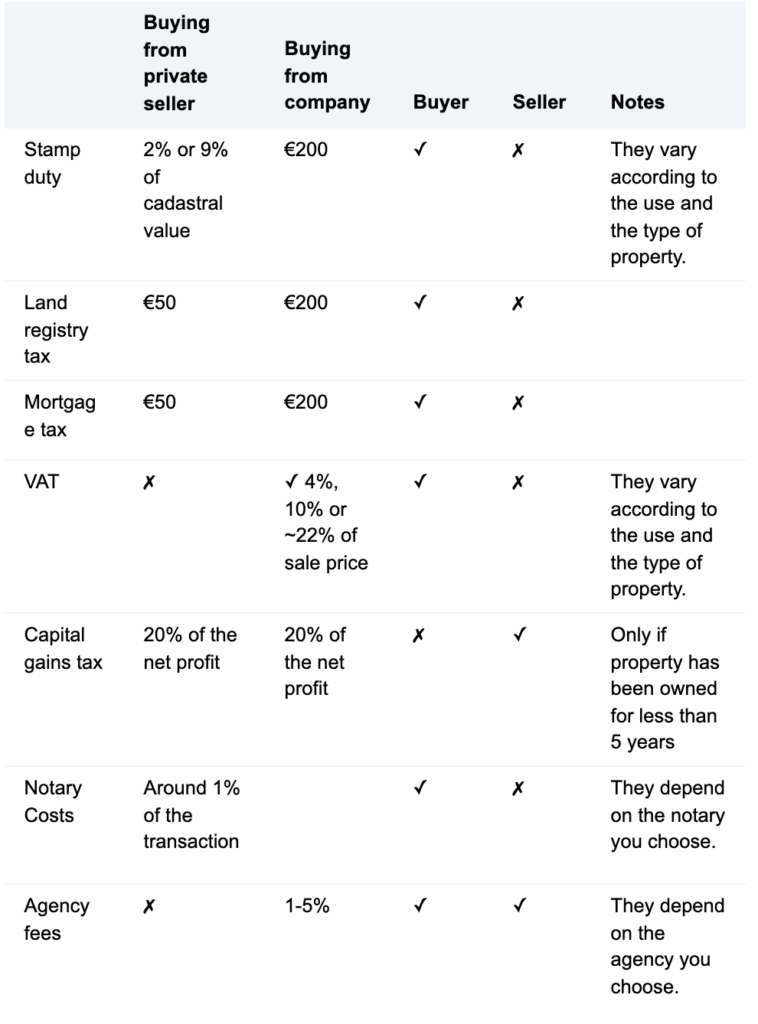

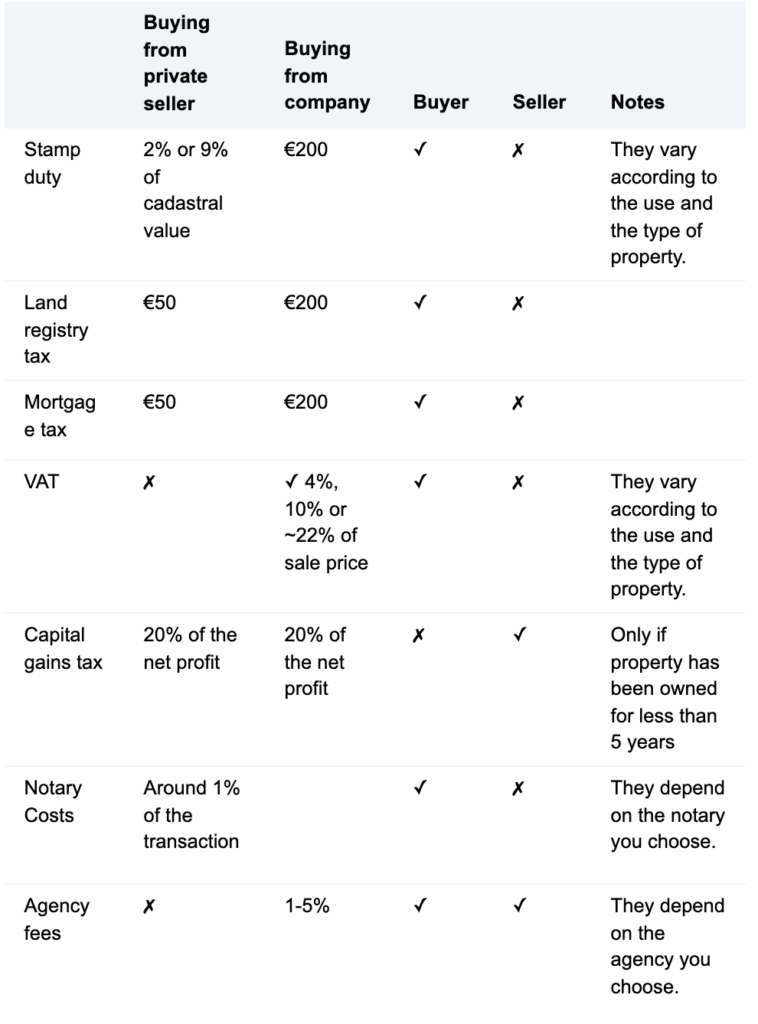

Here is a useful scheme provided by Gateaway:

The deed (in italian “rogito”), or public deed of sale, is basically the contract by which the transfer of ownership of the house is formalized and the price that the buyer paid to the seller to insure it.

2. Land registry Tax

This is due in order to change the ownership of the property in the cadastral lists.

3. The Mortgage Tax

4. VAT Tax

If you’re buying from a private seller, no VAT is due; however varies from 4% to 22% in case you purchase from a registered company. This tax varies according to the fact whether you are buying a primary house (4%) a secondary one (10%) or a luxury one (22%).

5. Capital gain Tax

Here are three aspects to consider about this tax:

- This tax is not due if you have owned the place for more than 5 years.

- If you are not resident in Italy you may have to pay this tax in your country.

- In all the other cases, you will have to pay around 26% on the net profit of the house; to calculate this you should detract from the profit the taxes, agency and building works you have done on this house. You may need an accountant to help you calculate those.

- There are many exemptions on this tax and in most of the cases you will not have to worry about it.

- This taxation of capital gains from the sale of properties, was applied to avoid the purchase of a house for speculative purposes only.

6. Notary costs

It is not a tax, but it is a cost you have to take into consideration.

Notary costs can vary according to the type of purchase you make. Is the property residential, commercial or are you changing the destination of usage of the property before the purchase? Is there any lease on the property? This may affect the costs related to hiring a notary. For registering the purchase of a house the costs of a notary, in general are no less than 1000€ or 1% of the transaction value.

7. Agency fee

A useful scheme to understand all the taxesHere in this table you can find all the costs connected with the purchase of a property in Italy.

Cost and Taxes related to owning a house in Italy

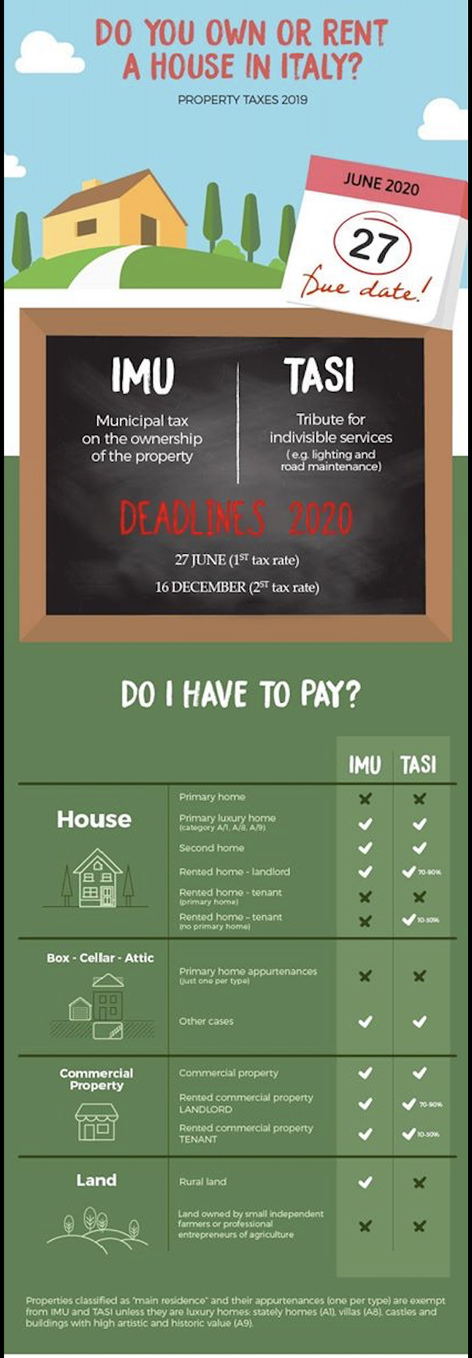

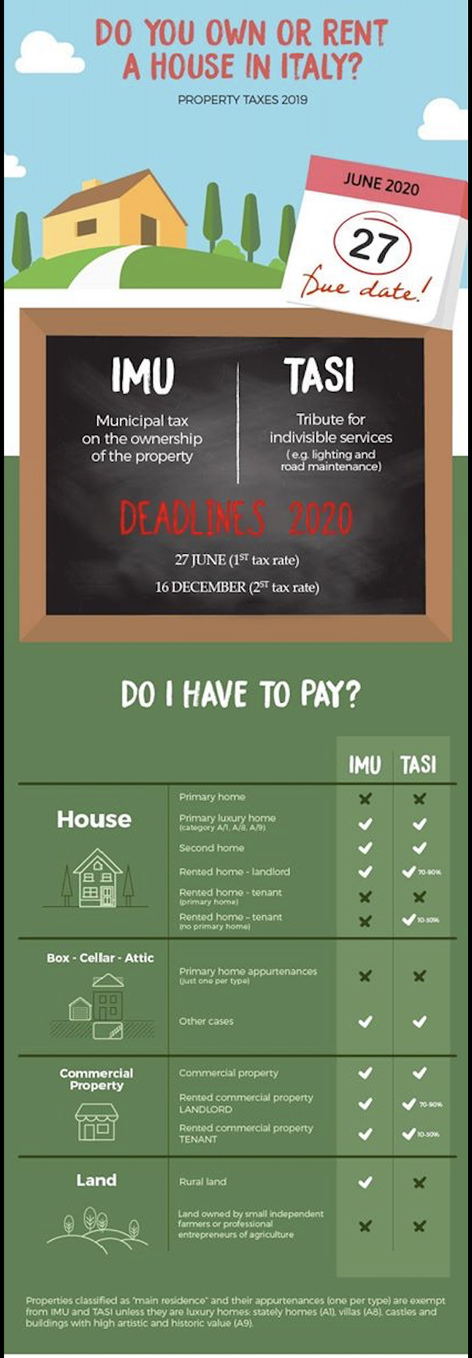

1. IMU

If your property in Italy is your main residence, and you live here for more than 6 months in a year then you do not have to pay this tax.

However if the house is categorized as luxury, you should pay it anyway, regardless the fact that is your main residence.So, also if the property in Italy is your second house, you should pay this tax.

It is around 5% of the catastral value of the house plus a 5% multiplied by a coefficient that varies from city to city.

In general on average it is 1,06% of the cadastral value revalued.

The municipality where your property is located will not send you a bill at home but they will only notify you of the deadline and the coefficient used.

To perform the calculation and the actual payment you may need to discuss that with your accountant.

2. TASI

Even if you decide to rent your place for the time you do not live in your house in Italy, this tax is still your responsibility. Therefore you may want to include these costs inside the rent.

3. TARI

For this tax you will receive a letter straight at your house address.

When to pay them

As IMU also TASI needs to be paid both in June and December.

Useful tips

In the table below, you can find more about this specifics.

Property taxes in Italy for non residents

Property taxes in Italy for non-residents who own property can be complex and vary based on the location and nature of the property. The main tax that non-resident property owners must pay is the Imposta Municipale Unica (IMU), which is a local property tax calculated based on the value of the property and the local tax rate. The IMU is due twice a year, in June and December, and the amount varies depending on the value of the property and the location.

Non-resident property owners may also be subject to the Tributo per i servizi indivisibili (TASI), a tax on services provided by the local government. The TASI is also calculated based on the value of the property and the local tax rate and is due in June and December.

In addition to the IMU and TASI, non-resident property owners who earn rental income from their property in Italy may be subject to income tax. This tax is levied on the net income earned from the rental property, and the rate varies depending on the amount of income earned.

It’s important for non-resident property owners in Italy to understand the tax laws and regulations, and it’s recommended to seek the advice of a tax professional to ensure compliance and minimize tax liability.

Final consideration

Relax, Do not panic and study them!

Furthermore, there may be many exemptions and state incentives when buying as well as maintaining a house in Italy depending on the type of property and its conditions.

Ask always the type of property your house is classified with to your accountant and what is the most convenient use of your property, taking into account your situation.

If you are buying a house in Italy, we strongly advise you to ask about these taxes to your seller.

Most of the taxes mentioned here, can now be paid online without much hustle.

If you are planning to rent your property in Italy or running a short term rental business in Italy, check also my article about how to run an airbnb in Italy.

If you want to learn more about this topic I suggest you to check out my book “The Italian Home buyer’s guide: the definitive guide for English speakers, expats, and non-Italian residents to owning property in Italy”.

Check out also our articles about filing your taxes in Italy, or airbnb taxes in Italy, or our guide for retiring in Italy.

Hi! Thanks so much for the article. It’s very clear! I have one question regarding point 5 – Capital Gain Tax. Does this also apply to real estate owned outside of Italy? If I’m a tax resident in Italy and I sell a property located abroad that was purchased more than 5 years ago, I’m given to understand the capital gain tax is not due in Italy. As I understand, the law makes no distinction regarding the location of the property (in Italy or abroad).

Your understanding is correct. No capital gains on residential properties owned for 5 years or more, regardless of their location

If a foreigner has a house in Tuscany and organises 1 week thematic retreats costing 6000 euros/person , hence 12000 euros/couple ; with 10 rooms he earns 120000 euros per retreat ; with 5 retreats he earns every year around 500000 euros.

My question is : is he obliged to declare them to Agenzia delle entrate ? Or it depends

wether he kept his fiscal residence abroad?

Thank you

Fabienne

This depends on multiple factors, can you please get in touch with us?

Hi

We are buying a house in Italy next month and will register in my name and my husband’s jointly. We are not residents but my husband will live in Italy a minimum of 6months a year after the purchase. I will be working abroad. Can we still buy it is as a primary property and pay the 2% stamp duty instead of. 9%.

Thanks

You are required to take up residence within a certain time period if you wish to pay the lesser tax.

If you do not intend to take up residence then the tax is 9%

and you both pay IMU property tax ..

Correct, within 18 months from the house purchase deed you need to establish residency in the Comune where the property is located in order to secure the 2% rate. Once you register your residency at your place, you can then waive the annual property tax due

I purchase in June 23 and my 18 months to establish residence is up in December….I have lived (Camping style) at my house for several; long stays but not fully moved in yet because: for 9 months there was no water or sewage, there is still not safe electrics, this and other essential works are due to start soon. So the house is not suitable to live in yet (although all my furniture is there), also I am in UK helping to care for my friend with Motor Neurone Disease, we are talking last few weeks or months of life and I hate to have to go now. Is there any way that I can get an extension on the 18 months….I am trying to be resident…I am well known in the village, all my stuff is there, have been working with geometra to organise renovation…. Your advice much appreciated and also to know your fees if you can help me.

the various COVID extension provided an extension to October 31st 2023. Meaning that you have time until march 31st 2025 to claim residence in your dwelling and avoid any registrar tax claw back

Excuse my ignorance!! Does that mean as a couple would you end up paying 50% of the 9% property tax each or 9% each?

9% in total

Hi there,

I would like to know if a Italian working abroad, but owning a property which was his residence. (If your property in Italy is your main residence, and you live here for more than 6 months in a year then you do not have to pay this tax.)

It is obligated to pay taxes because now he moved to other country because of work and paying rental in the other country.

Thank you!

if you are registered as a resident in the property, you should not pay any property tax

Hi – my daughter lives and studies in Italy. I want to buy an apartment for her, this would be her registered address, but I would keep the property on my name. (I do not live in Italy.) Can I use the 2% stamp duty or do I have to pay 9%?

Thank you!

You need to pay 9% in that case

we plan on moving to civitavecchia and plan on spending $100000 for an apt canyou give us a ball park number paying notary agencies etc. thankyou

agencies normally charge 3% of the transaction value. However, this can be negotiated or reduced given the large investment.

Notary and taxes depend on the property tax value

Hi Nicolò,

We are buying a property in Puglia.

My wife will become resident after the purchase but I will not be resident.

If we buy the property in BOTH our names will we need to pay the higher 9% and IMU ?

Or. Do we BOTH need to be resident to only pay the lower 3% and IMU?

Thanks

Carl

your wife can claim 2% and no iMU, while you have to pay IMU and 9% at purchase

So useful! To be clear, as we have the same question, if the spouses pay 50-50 for the purchase of the flat, the resident spouse pays 2% on 50% of property value and the non resident partner pays 9% on the other 50%?

Grazie mille

That’s correct

If I am a resident and live 6 months a year in villa home. What would the tax be on purchase and what would be the annual taxes I would expect to pay?

This all depends on the rendita catastale of your property

I am an Italian citizen and currently live in the US. I have a home in Italy. If I plan to move to Italy for 6 months how do I apply for residency and will I then be able to pay the 2%IMU. Thank you for your help.

You need to retain your residency in Italy for longer than 6 months to benefit of the 2% registrar tax rate

RE Capital Gain Tax

Good afternoon, I’m relocating from US buying a permanent home in Italy, and selling my US residence. Do I understand; as I am becoming a fiscal resident of Italy, when the US home sells (which I have owned more than 5 years) I will not pay Capital Gain tax on that sell? In either Italy or US (if true-yippee!)

That’s absolutely correct! no cap gains on real estate properties owned for 5 years or more

Hi there. I have two questions. 1. I’m a resident of Italy since 3 January 2023 and I own a home here. I’m concerned about the 2% registration fee I paid when buying the home, which was based on residency. I have read that the fee could be raised to 9% and a fine imposed if I sell the home before five years. Is this true? 2. If I move back to the US but keep the house as a vacation home, will I pay IMU if I am an Italian citizen and registered with AIRE? Thank you in advance. And I will be contacting your office for services in the next few days.

1. no

2. yes you will

Hello, my father in law co-owns the house in Italy with his brother, but lives in Canada. His brother lives in the house in Italy. My father in law just received the foreign tax bill for the property, since he lives in Canada, along with the waste collection fee. First of all, if he doesn’t live in Italy, we are wondering why he is getting billed the waste removal fee and not the occupant (his brother). Secondly, my father in law would like to remove his name as part owner on the house, giving it to his brother 100% (and stop being billed for taxes as he is now elderly and it is stressing him out). Any idea the process for removing himself as part owner? Thank you very much.

the only way is to donate the property to his brother. it’s strange you get the waste tax in Canada, the occupant should get it

Did you liaise with the local Comune?

If vendor has not paid his property taxes to date as of the date of sale, do these

arrears stay with the vendor or get transferred to the purchaser.

Those are normally charged in the notary fee.

I do not live in Italy. I have property in the country is worthless. But I believe

IMU is being charged because there is a building in the country which is in structurly in disrepair. What happens if I don’t pay the IMU?

I have US / Italy dual citizenship. I am a US resident registered with AIRE. I recently retired and want to spend about 6 months a year in Italy. I would like to rent an apartment year round so I can come and go when I want. If I enter into a long term rental contract will I have to file and possibly pay taxes in Italy even though I will stay less than 6 months a year? Do I have to register as a resident?

Likely not. On top of that, you may be deemed as a resident of Italy but avoid taxation if the Double Tax Treaty art. 4 applies to you

Hello, Does the tax rate change if you add a swimming pool to a house?

The tax rate remains the same, however the rendita catastale of the property increases resulting in higher property tax due

My husband is English , I’m American. We live in America. If we acquire a long term resident permit for Italy, can we pay the 2% instead of 9% when we purchase? And no IMU?

That’s correct, you can do that

I do not live in Italy. I have property in the country that is not

worth the taxes being charged. What happens if I don’t pay

these taxes? Is a lien put on the country property?

I do not live in Italy. I have property in the country is worthless. But I believe

IMU is being charged because there is a building in the country which is in structurly in disrepair. What happens if I don’t pay the IMU?

I own a house in Italy, and am curious if I purchase a garage in a nearby town how does that get taxed, or would that only be if I owned a second residence?

That’s taxed if not attached as the primary residence

I own a property in Calabria I am a resident here o have a house in the uk I have italic passports and I am a pension do o still have to pay taxes

if you reside in Italy, yes

RE – Capital Gains tax on sale.

Please may I ask for clarification on capital gains tax payable if,

I have owned the property in Italy for less than 5 years and wish to sell it,

I have residency at the property,

I have lived at the property for 100% of the time of ownership.

I hope to sell for a higher price, than I paid for the property at time of purchase.

there is conflicting information on the web in relation to my enquiry.

I have bought an house under construction in Italy. The house in that situation in not inhabitable. Do I have to pay taxes ?

depends on the classification of the property itself. normally you don’t pay IMU on such properties

Hi, I am interested in buying a property in Italy. When the size of the property is considered, is this the total land area (including orchard) or the built-up area?

Secondly, if IMU is 5% of cadastral value of the property every year, a property purchased at €200k would incur an annual tax of €10k? Is the cadastral value revised every year? Say if this value increases to €300k, then the IMU is raised to €15k?

Thanks!

no, the IMU ups to 1.06% of the cadastral value which is not subject to updates in the event of property upgrade

Ciao, I have a couple questions, if you would be so kind as to answer.

I am a dual Italian/Canadian citizen, registered in AIRE. I am a pensioner in my home country of Canada. I am interested in buying property in Italy, solely for the sake of visiting a couple months in the summer. It would be around Lake Como and have a value of approximately 100,00 euros. One, I am wondering what my VAT rate would be? Two, I am wondering what my IMU would be, given that I am pensioner! Grazi mille per la vostra risposta.

there is no VAT if you buy it from a private owner. Furthermore, as an Italian citizen and pensioner, you should be waived from annual IMU payments

I have owned a small piece of land in Italy since 1976 and I have arranged for my relatives to pay the annual fondiaria. Is there a way for me to make direct annual land payment to the italian agency from the USA.

if property tax you should liaise with the local municipality and request the bank coordinates to transfer the funds to

I have owned a small piece of land in Italy since 1976 and I have arranged for my relatives to pay the annual fondiaria. Is there a way for me to make direct annual land payment to the italian agency from the USA.

Thank you

Joseph

if property tax you should liaise with the local municipality and request the bank coordinates to transfer the funds to

I am 70 years old and left Italy for Canada when I was 7 years old. I have retained my Italian citizenship and have an Italian passport. I plan to buy a house in Italy in the town I was born and want to know if I am eligible for the “Prima Casa Tax Reductions” ? One of the conditions is that ” you lived in Italy for at least 5 years, moved overseas for work, and that the property you are buying is located in the Italian Municipality where you were born, or where you lived, or where you worked.” Do I satisfy the conditions?

it seems you do!

We are buying a house in Lecce for $130k euros . What is the estimated cost in fees and notary and taxes? Just an estimate. By the way we are applying for Italian citizenship and the lawyer says we will sure get it before the 18 months are up. We plan to remodel and live there 6 months out of the year for the next 5 years .

hard to tell, as notary fees vary. You can claim the 2% tax if you register within 18 months

My husband is Italian & I am English, we live in Uk. We are thinking of buying a village house for 40k. We will be using as a holiday home and will still live in England. Do you have any idea what we will pay in taxes on the property and is this paid in a lump sump at the time of purchase? Also what will we pay on an annual basis. Thanks in advance

The registrar tax is paid at deed date, and it is based on the cadastral value of the property; if you know the rendita catastale, you can calculate that. You then need to self assess the ongoing property tax, unless you register as a resident at your property

If I buy a vacation home for 20000 euros what are the costs at purchase and then yearly after that? Also if water, sewer and garbage available what is the approximate cost of these services ? thanks

the registrar tax depends on the cadastral value of the property, regardless of the purchase price. THe garbage tax depends on the local council, which normally sits at € 300/year

Good morning! I have bought a property in southern Italy and we are awaiting the definite PdC before we can start finishing the house. This might still take a while as good builders are still very busy due to the 110% bonuses. In the meantime I have become a resident in the village where I bought the house at the address of the small apartment I currently rent.

The new house is not more than one of the (in)famous ‘skeletons’, so I am not able to actually live there for many moons to come.

Italian friends warned me yesterday, that due to having 2 official addresses (the bought house and the rented apartment), the tax authority (and the Comune!) can tax me on both. Is that true and is there a way to avoid that?

Thank you for your advise…

are you referring to property tax or other types of taxes?

I am no longer sure where you’re getting your info, however good topic. I needs to spend a while learning much more or figuring out more. Thanks for excellent information I was on the lookout for this information for my mission.

It is appropriate time to make some plans for the future and it’s time to be happy. I have read this post and if I could I desire to suggest you few interesting things or advice. Perhaps you could write next articles referring to this article. I want to read more things about it!

Hello there, I am Italian but have been living in the UK for the past 20 years or so. I owe a flat which I am planning to sell which was purchased in 2006, that that has been my main home. What would be more convenient tax wise? Would it be better to sell the flat while still in the UK and move back to Italy once the sale is completed, or relocate to Italy first and sell the flat once I’ll be Italian resident ?

Also, in both cases, will I have to pay CGT?

no CGT on the Italian end, therefore it is advisable to sell it once you relinquish your UK residency

This article has been my go-to resource whenever I need a dose of inspiration or guidance. Thank you for being a source of motivation!

Hello Nicolò,

Thanks for the article, which is very informative. I’m still confused about one thing and I wonder if you could answer this question:

I bought a house in Italy in December 2023, paying 2% stamp duty tax, and am now applying for residency, however, I don’t want to become a fiscal resident. I have dual UK and Irish nationality.

Can I qualify for residency whilst staying for less than 180 days per year?

Thanks, Peter

If you register as a resident at your property you are de jure a tax resident of Italy starting from your registration date. If you are deemed as a tax resident of another foreign country with which Italy has a double tax treaty in place, you may not be required to pay any income tax to Italy

Cool blog post! Your writing is informative and always a joy to read.

Great job on this post! I love how you keep your blog so engaging and informative.

I admire the dedication you show in each post. Your blog really stands out!

I really enjoy the variety of topics you tackle. Your blog is very good at keeping readers engaged.Taking a look forward to look you.

Your posts always brighten my day. Thanks for sharing such uplifting content.

Thanks for another cool post! Your blog is bookmarked for daily visits.

This article is fantastic! I learned a lot from your detailed explanation.

A big thank you for this wonderful article. It was a perfect mix of informative and engaging!

I’m grateful for the effort put into this article—it really shows. Thank you!

My mother has been living in United States for over 60 years. Her father passed years ago and left property for herself, and two siblings, who both have lived in Italy there who lives. The property is abandoned for over 15 years. She doesn’t want the property and has never paid any taxes on the property. She was told that Italy government will go after her US pension/ social security. Is this true ? Thanks

almost impossible

Very informative article.

I am in the process of buying an apartment at Lago di Como. I didn’t make a formal offer yet but the price should be agreed on between € 180-200k. It will be a second home, non resident. And the idea is to rent it out for about 16 weeks in total in the period form May to October.

The real estate agent was informing me about the fact that the cadastral value of the property is €418,33.

As I am planning on taking a 100k mortgage (if possible with this cadastral value), I am wondering how the financials are going to look like regarding taxes etcetera.