Italy leads Europe with over 5 million self-employed individuals, a trend that keeps growing, as highlighted by the Ministry of Economy and Finance’s Observatory. In the second quarter of 2023 alone, a substantial 118,215 new Partita IVA registrations were recorded, indicating sustained interest in independent professional endeavors.

Delve into the process of obtaining your Partita IVA as an expat and contribute to the dynamic entrepreneurial spirit that defines Italy’s economic landscape.

What is Partita IVA in Italy?

The answer to this question can be found in this video:

In short, the Partita IVA number in Italy is a unique identification number assigned to businesses and self-employed workers for tax-related matters. It plays a fundamental role in distinguishing business entities from individuals and is essential for complying with Italian tax regulations. Having said that, you may have further questions about it, so let’s tackle a couple of the most common ones.

Is a VAT-registered business the same as a Partita IVA?

While having a Partita IVA implies VAT registration, it encompasses a broader scope, serving as a unique identifier for various fiscal purposes beyond just Value Added Tax. It is crucial for conducting business transactions, issuing invoices, and fulfilling tax obligations in Italy.

What is the difference between Codice Fiscale and Partita IVA?

The Codice Fiscale and Partita IVA serve different purposes in Italy. The Codice Fiscale is a general tax code used for personal transactions, while the Partita IVA is specifically designated for business activities, functioning as a VAT number for taxation purposes.

Determining the Need for Partita IVA in Italy

If you have looked into opening a Partita IVA before, it’s likely you may have heard lots of different things from friends and acquaintances, so let’s clear up matters.

If you’re looking to set up a shop or a company, the Partita IVA is mandatory.

Professions that are legally regulated, such as healthcare professionals, lawyers, architects, and engineers, require a Partita IVA for self-employed workers.

However, confusion may arise if you plan to work as a freelancer or independent contractor offering services like translations or marketing consultancies. A persistent rumor suggests that registration is unnecessary as long as you don’t earn above €5000. This is not accurate.

The Agenzia delle Entrate (the Italian Revenue Agency) has made it clear that any professional activity you carry out continuously and over time requires a Partita IVA.

Occasional Work Income Scheme (Prestazione Occasionale)

The Occasional Work Income Scheme (Prestazione Occasionale), which is where the €5000 threshold stems from, is meant for people who rarely provide services, for example a university student who, once a year, works the registration desk at an event or an IT expert that in their spare time helps their neighbor fix a computer one day. You can watch this video on the subject to learn more.

Under this scheme, there is no limit to what you can earn, but if your overall income is over €5000 then you’ll need to file your taxes (dichiarazione dei redditi).

For each service provided you’ll need to present your client with a notula, which is a sort of invoice and you need to set aside 20% of the amount for the ritenuta d’acconto tax, which is nothing more than an advance on the taxes that those who receive your notula must withhold from the fee and then pay to the Italian Revenue Agency.

Moreover, the person who hires you must inform the appropriate Territorial Labor Inspectorate about the collaboration. If the arrangement is not compliant with the law, you might face fines.

As you can see, it may not be all that convenient to resort to this scheme at all if you plan to work regularly.

Requirements for Partita IVA

To qualify for a Partita IVA, individuals need to meet specific criteria:

- Applicants must be over 18 years old.

- Individuals should be of sound mind.

- It is necessary to reside within the national territory.

Even if you’re not a citizen, you can still open a Partita IVA as long as you’re a resident. However, what if you’re not a resident yet? And maybe not even in the country?

EU citizens

For EU citizens, resettling in Italy is relatively straightforward; they can work without permits (except for regulated activities) and only need to register with the City Hall (Comune) where they live.

Non-EU citizens

Non-EU citizens might need to explore the Self-Employment Visa, subject to limited yearly quotas. Navigating this process involves gathering information on available quotas, meeting general eligibility criteria (such as suitable accommodation, financial resources exceeding €8,500, mandatory police clearance, and requisite certificates), and understanding the discretionary power of Italian Consulates in the final decision-making process. Despite meeting criteria, applicants often encounter rejections, underscoring the importance of thorough preparation and a nuanced understanding of the visa issuance process.

Foreign citizens

Foreign citizens who are not residents or lack a permanent establishment can apply for a Partita IVA in Italy by appointing a tax representative. This representative, acting on behalf of the applicant, submits the request to the tax authority Agenzia delle Entrate where the applicant is going to live.

You can get your Partita IVA even if you have a study visa, as there are no restrictions on freelancing while studying in Italy. Moreover, upon completing your studies, you can obtain a lavoro autonomo residence permit, enabling you to stay in Italy without the need to return to your home country for processing a new visa.

What are the different types of Partita IVA?

When establishing a Partita IVA, you will need to decide on the appropriate tax and accounting scheme for your business, along with its legal structure. This choice holds significance as it determines your taxation, fiscal obligations, accounting practices, and social security commitments.

At present, there are three main schemes (regime): ordinary (ordinario), simplified (semplificato), and flat-rate (forfettario).

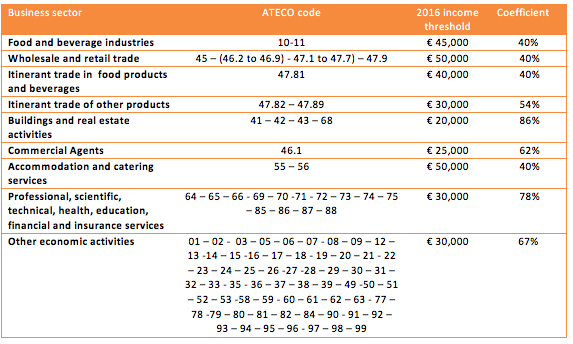

Alongside this decision, you must identify your business’s ATECO code, an alphanumeric classification that categorizes economic activities. This code is a mandatory inclusion in the Partita IVA application. The current classification, managed by Istat, is ATECO 2007, last updated on April 1, 2022.

Let’s delve into the differences between the various tax and accounting schemes.

Օrdinary scheme (partita IVA ordinaria)

Within the ordinary scheme (partita IVA ordinaria), income tax (IRPEF) is calculated in distinct income brackets, while Value Added Tax (VAT) is applied to the sale of goods or services. This detailed regime necessitates thorough accounting practices and the upkeep of various registers. It is obligatory for:

- Capital companies.

- Partnership companies with revenues exceeding €500.000 for services and €800.000 for other activities in the previous year.

Simplified scheme (partita IVA semplificata)

Conversely, the simplified scheme (partita IVA semplificata), as the name implies, offers a more straightforward application compared to the ordinary system while encompassing the same tax obligations. It also diminishes accounting responsibilities for activities falling within the following turnovers:

- Up to €500.000 in revenue for service-related activities;

- Up to €800.000 for other activities.

Flat-rate scheme (regime forfettario)

The facilitated or flat-rate scheme (regime forfettario) can be adopted by individuals engaged in business or professional activities (as established by Law 190/2014, Article 1, paragraph 54). This includes family-run businesses and marital enterprises not managed as corporate entities. To adopt the facilitated scheme, revenues or fees from the previous year must not exceed €85.000.

Regarding taxation:

- A substitute tax of 15% is applied to the taxable income, and this rate is reduced to 5% for the first 5 years of activity.

- No obligation for accounting records, application, liquidation, and payment of VAT;

- No mandatory withholding taxes (ritenuta d’acconto);

- Artisans and merchants can request a 35% reduction in pension contributions.

After choosing the tax scheme, you will also need to select the legal form of your business from the following options:

- Sole proprietorship (family or marital enterprise)

- Self-employed and professionals

- Partnership companies

- Capital companies

- Cooperatives

How much can you expect to pay in taxes?

The taxes you must pay depend on the tax and legal category you choose for your Partita IVA. For the regime ordinario and regime semplificato, the applicable taxes are:

- VAT (IVA): Applied to invoices with a variable rate depending on the goods or services provided.

- IRPEF: Increases based on income and is mandatory for individuals, including sole proprietorships and freelancers.

- IRES: Applied to the revenue of the company and currently stands at 24%.

- IRAP:The ordinary rate is 3.9%, but each region can decide to increase or decrease it (up to a maximum of 0.92 percentage points). Individuals, including freelancers and sole proprietorships are exempted.

For regime forfettario, the taxes to be paid include:

- Substitute tax at 15% (reduced to 5% for the first five years of activity).

The income brackets and IRPEF rates for 2024 are as follows:

| Taxable income brackets | Tax rate | Due tax |

| up to €28.000 | 23% | 23% of the entire yearly income (= €3.450) |

| Between €28.000 – €50.000 | 35% | €6.700+ 35% of the yearly income |

| Above €50.000 | 43% | €14.400 + 43% of the yearly income |

Social security contributions

If you have a Partita IVA, you must pay contributions to INPS (the government office in charge of social security, retirees and pensions) or to a guild retirement fund.

Paying these contributions allows you to fund income support benefits, social safety nets and of course your future pension.

If there is a retirement fund for your profession, as is the case for regulated professions such as for architects or doctors, you won’t need to contribute to INPS but directly to the guild fund.

If there is no guild fund for your profession, and you are registered as an artisan or merchant (Gestione Artigiani e Commercianti) or the separate management (Gestione Separata INPS), you’ll have to contribute to INPS.

Social security contributions when Gestione Artigiani e Commercianti applies

Don’t be fooled by its name, this category includes a plethora of different professions, from online shops, to plumbers, hairdressers, advertising specialists, tattoo artists, etc…

If you fall into this category of self-employed workers, you need to pay two types of contributions to INPS: fixed and variable.

Fixed contributions are those you have to pay regardless of your earnings and amount to €4,208.40 for artisans and €4,292.42 for merchants.

In addition to these, there are variable contributions, but to understand those you’ll first to understand what net taxable income means.

This is the difference between your earnings and the expenses you incurred for your business. Expenses can be deducted directly, if you are in the regime ordinario, or estimated, if you are in the regime forfettario.

The variable contributions must be paid if your net taxable income exceeds €17,504. On any amount exceeding this, contributions represent 24% of that amount if you’re an artisan or 24.48% if you’re a merchant.

Social security contributions when Gestione Separata applies

The separate INPS management is the fund to enroll in if you’re neither an artisan nor a merchant and lack a specific private category fund, for example, if you’re a copywriter or a graphic designer.

To determine your contribution amount, it’s crucial to find your net taxable income. On this value, you apply a percentage of contributions that varies annually and, for 2023, stands at 26.23%.

The pros and cons of the regime forfettario

The flat tax, as it’s been called by the media, sounds enticing, particularly the 5% taxation over the first few years, but it’s not always the best choice and your Partita IVA type should be chosen with an accountant who can advise you on the type that best suits your needs.

The obvious advantages of scheme

- The lowest taxes

- No need for bookkeeping

- Simplified accounting

However, not many are aware of the limits this scheme comes with:

- You cannot deduct any expense, for example healthcare, insurance, new work equipment or transport.

- You cannot hire employees that would cost you more than €20.000 per year.

- Your main source of income cannot come from digital products (e.g. ebooks, online courses). This scheme is meant for individuals providing professional services.

As you can understand, if you need to purchase expensive equipment constantly or need to travel for work, the regime ordinario semplificato may be more beneficial for you.

In some cases, it’s actually not even possible to open a Partita IVA forfettaria at all and these include:

- Agriculture and related activities

- Fishing

- Sale of tobacco

- Matchstick trading

- Publishing

- Public telephone service management

- Resale of public transport tickets

- Entertainment

- Games, and other activities

- Travel and tourism agencies

- Farmstays

- Door-to-door sales

- Resale of used goods

- Art objects, antiques, or collectibles

- Auction agencies for art, antiques, or collectibles, and the sale of scraps

Non-residents

Non-residents in Italy are also excluded from the flat-rate scheme.

However, if you are a non-resident in Italy, you can access the flat-rate regime if you reside in a European Union member state or in a state adhering to the Agreement on the European Economic Area that ensures adequate information exchange and generate at least 75% of your total income in Italy.

The flat-rate scheme is also not available to those involved in the sale of buildings or portions of buildings, buildable land or new means of transport.

As this scheme is meant for individuals who mainly work alone, anyone who’s in partnerships, professional associations, or family businesses or anyone who has shares in limited liability companies is also excluded from applying.

Tell your tax advisor if you had a job before. The flat-rate system isn’t for you if most of your work is with current or past employers from the last two tax periods or with people linked to them.

Moreover, this scheme is not available to those who earned income as an employee exceeding €30,000 in the previous year, regardless of whether they no longer work there.

Confused? We can help! Get in touch and let us clear your doubts, we speak English!

Would you like to learn more about this subject? Check our related articles here: Freelancing in Italy: Pros & Cons In 2024, Path to residency: Italy’s permit of stay requirements and Everything you need to know about renewing your permit of stay in Italy