Italy’s beautiful landscape, rich history, vibrant culture, and delectable cuisine captivate visitors and corporations worldwide. However, if not planned beforehand, starting a business or travelling can be expensive if not budgeted properly. Understanding the budgetary aspects becomes crucial for maximizing your time and money in this enchanting destination. This article delves into Italy’s budget law for 2023, corporate tax rates, living costs, and financial considerations, providing valuable insights for both travelers and residents seeking to make the most of their experiences.

Heading 1: Italy’s Budget Law for 2023: An Overview

Italy’s government has approved a €35 billion budget law for 2023, signifying a major financial milestone. This comprehensive financial plan actively allocates funds to critical sectors such as healthcare, education, infrastructure, and social welfare programs. By doing so, the government explicitly addresses pressing issues that include unemployment, public debt, and sustainable development, aiming to steer the country towards economic prosperity.

Understanding the intricacies of these budgetary allocations becomes paramount for businesses to strategize their operations effectively, seizing potential opportunities or devising solutions to navigate challenges. Likewise, individuals can use this insight to plan their finances prudently, aligning their personal economic goals with the broader national priorities.

In addition to its direct impact on the sectors it funds, the budget law plays a pivotal role in setting the tone for fiscal policies and economic prospects throughout the country. This, in turn, renders it an indispensable reference point for investors and analysts alike, enabling them to make informed assessments of Italy’s financial outlook and potential investment climate.

Heading 2: Italy’s Corporate Tax Rate in 2023

As of 2023, Italy implements a corporate tax rate of 24%. This rate exerts a significant impact on the business landscape and drives investment decisions for both domestic and foreign companies. Maintaining a competitive corporate tax rate serves to attract foreign investment, foster business growth, and stimulate overall economic development, potentially resulting in job creation and heightened revenue generation.

Staying continuously updated on tax regulations holds crucial importance, ensuring adherence to compliance requirements and optimizing tax strategies for businesses. A comprehensive understanding of tax incentives and deductions further bolsters competitiveness and contributes to the long-term financial sustainability of companies operating in Italy. Being proactive in leveraging these opportunities can provide companies with a competitive edge and position them favorably in the market, while also aiding in their financial stability and growth prospects.

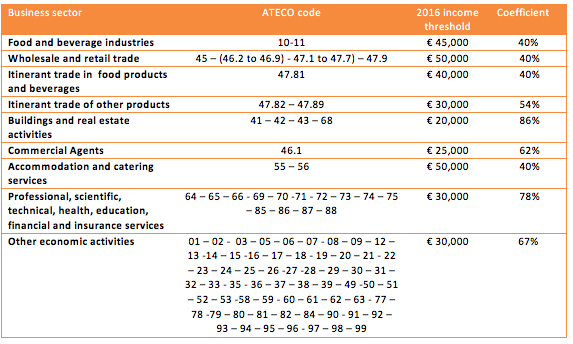

Heading 3: Income Threshold for Paying Tax in Italy

In Italy, the income threshold for paying tax varies depending on one’s residency status and the amount of income earned. For residents, a tax-free threshold is granted up to a specific income level, beyond which progressive tax rates come into effect. Non-residents, on the other hand, encounter a flat tax rate applicable to their Italian-sourced income. It is crucial to grasp the nuances of tax brackets and actively explore available deductions and tax credits to optimize taxable income.

Staying informed about changes in tax regulations and seeking advice from tax experts can ensure individuals make the most of the tax system. Taking proactive steps to understand and manage tax obligations enables residents and non-residents alike to navigate Italy’s active tax landscape confidently. By engaging in financial planning and tax optimization, individuals can effectively manage their tax liabilities and make informed decisions concerning their income in Italy.

Heading 4: Income Tax in Italy for Foreigners

Foreigners residing in Italy need to grasp the intricacies of the income tax system, which is based on their residency status and specific circumstances. In general, non-residents will find themselves subject to taxation on Italian-sourced income, while residents are liable for taxes on their worldwide income. Navigating the complexities of the Italian tax system and optimizing tax liabilities can be achieved through seeking professional tax advice. Such guidance enables foreigners to identify potential tax-saving opportunities, efficiently handle tax compliance, and make well-informed financial decisions.

Additionally, tax advisors with expertise in both Italian and international tax regulations provide valuable insights to expatriates, ensuring they make the most of available deductions and credits to minimize their tax burdens. Staying informed about any changes or updates in tax laws is crucial for foreigners to adapt their financial planning and remain compliant with the Italian tax requirements. By doing so, foreigners can confidently navigate the Italian tax landscape and ensure their financial affairs are in order throughout their stay in this captivating country.

Heading 5: Financial Challenges in Italy

Financial challenges in Italy significantly impact residents and businesses, compelling them to actively navigate through a complex tax system with the help of professional advice. Furthermore, bureaucratic hurdles and high administrative costs actively hinder business growth and investment. Staying actively informed about economic trends and policies is crucial as it enables individuals and companies to proactively mitigate risks. Additionally, keeping up with the latest financial developments empowers stakeholders to adapt their strategies and make informed decisions. Active awareness of potential regulatory changes allows for timely adjustments to financial planning, ensuring active compliance with evolving laws and regulations. By engaging with experts and staying informed, individuals and businesses can actively and effectively address Italy’s financial challenges and actively seize opportunities for growth. Taking proactive steps in financial matters ensures a strong and resilient approach to navigating Italy’s budget landscape.

Heading 6: Exploring Italy on a Budget

You can experience Italy on a budget by choosing affordable accommodation like hostels or budget hotels. Local eateries serve authentic Italian dishes at reasonable prices. Public transportation and city passes cut down on travel costs, granting easy access to popular destinations. Exploring free or low-cost attractions lets you immerse yourself in the Italian way of life without straining your budget. Opting for walking tours or bike rentals allows you to explore the charming streets and countryside without spending a fortune. Engaging in local events and festivals gives you a taste of the cultural richness without breaking the bank. Additionally, shopping at local markets and supermarkets for fresh produce and groceries provides cost-effective dining options, making your budget-friendly trip an unforgettable experience. Moreover, interacting with locals opens up opportunities to learn about their traditions and customs, enhancing your cultural immersion while staying within your budget.

Conclusion

Having a comprehensive understanding of Italy’s budget law, corporate tax rates, and living costs is essential for individuals and businesses to make informed decisions while enjoying the country’s offerings. Whether planning a trip, conducting financial matters, or engaging in investment opportunities, being well-informed empowers proactive decision-making in Italy’s captivating and economically vibrant landscape. Staying updated with the latest financial trends and policies ensures a rewarding and successful experience in this diverse and enchanting destination.

If you are interested in similar topics take a look at our related articles, Italian corporation tax rate: our financial guide, Income Declaration in Italy and Income tax rate in Italy: 2020 Guide for foreigners.