Guide to the fiscal, administrative, and contributory regulations for becoming a photographer. VAT number, tax regimes, freelance photographers, and those who intend to start a business related to the photos they take and produce.

Do you want to start a photography business? Do you want to know what you need to do to start your business safely? Not sure what taxes and contributions you’ll have to pay? You’ll find all the answers you need in this guide!

The photographer’s activity often begins by making photos for pleasure, resulting in time, a real job, or the activity begins after following specific courses on the subject.

Of course, technological innovation has also played a role in making this activity popular, especially in recent years.

For this reason, I thought to write a guide related to tax compliance accounting and contributions that may be useful to all those who intend to become a professional photographer, not to mention our helpful advice for the exercise of this activity.

Become a photographer: the type of activity

From a tax point, the activity of the Photographer can opt among three different profiles, different from each other, related exclusively to how you decide to carry out this activity.

In particular, we may be faced with these cases:

- Freelance Photographer – This is the photographer’s activity who fully exploits his interpretative and creative skills to create photographs, or more generally, advertising graphics. The Photographer acts as a freelancer (an activity for which there is no registration with a register). In this case, the photographer acts autonomously and personally (he cannot act in the form of a company) and does not market his works with a fixed structure. The photographer is required to contribute to the Inps Gestione Separata;

- The activity of Photographer in the form of enterprise – This is the activity of the Photographer who, in addition to making photos on commission, is mainly based on the existence of a structure, such as a photographic studio, or a shop, with which he makes photos, portraits, etc., and with which he exercises a commercial activity of sale. This form of activity can be carried out either individually or as a company. In this case, contributions are due to the commercial management of the Inps;

- Transfer of copyright – This is a very particular activity related to the transfer of the right to use images of an interpretative or creative nature for editorial or book purposes. This form cannot be applied for commercial or advertising uses.

Occasional photographer

All three of these cases involve a different way of exercising the same profession, that of the photographer practicing professionally.

Those who work in a very occasional and episodic way can take advantage of the benefits of occasional self-employment.

However, occasional self-employment does not apply if the activity is carried out habitually, or with a certain frequency, regardless of the volume of receipts, Note that the € 5,000 is a tax myth.

In these cases, it is compulsory to carry out the activity with one of the three cases mentioned above, under penalty of administrative sanctions by the Inland Revenue, related to the non-invoicing of operations for VAT purposes.

Please note that each case of the three indicated above provides a different method of determining professional income and a different taxation system.

For this reason, it is appropriate to verify in advance which case is more similar to the actual activity of the Photographer that you are exercising. For this reason, the help of an accountant expert in the field becomes a fundamental element for the conduct of the professional activity.

Freelance photographer: Ateco tax code and VAT number

Becoming a Freelance Photographer is the dream of all photography enthusiasts. Living exclusively on your passion for making perfect artistic shots is the activity of the Freelance Photographer.

As we said, the freelance photographer works on commission to realize shots, photo shoots, or artistic achievements on commission from the customer. In this case, the element that distinguishes this type of activity is the pre-eminence of the creative part on the commercial one.

As we have said, the activity of Freelance Photographer concerns subjects who habitually carry out this type of activity on commission of third parties during the year.

ATECO activity code of the freelance photographer

These subjects are required to open a VAT number at the Revenue Office, using one of the following activity codes:

Activity code 74.20.19 Photographic studio activities and photographic filming activities of all kinds

Activity code 74.20.20 Processing and printing activities of photographic studios on a fee or contract basis

activity code 74.20.11 Activities of photojournalists

The opening of the VAT number is the first tax requirement to be made to become a professional photographer. With the opening of the VAT number is also necessary to choose the tax regime to be applied.

The fiscal regime of the Freelance Photographer: VAT and Regime Forfettario

For professionals, it may be advantageous, if you meet the requirements to join the so-called “RegimeForfettario,” governed by Law No. 190/2014, as amended by LawNo. 208/2015.

This regime provides flat-rate taxation of the professional income deriving from the activity, calculated as a percentage of the annual revenues. Revenues cannot exceed €. 65,000 per year, and the compensation percentage is 78%.

This means, for example, that if the annual revenues were €. 10,000 the flat-rate costs are €. 2,200, and the taxable income €. 7,800 (78% of €. 10,000). On this income, the substitute tax of 15% is applied, which for the first five years of activity can be reduced to 5%.

As an alternative to this simplified regime, those who can not access it will automatically enter into simplified accounting, which provides for the taxation of professional income to Irpef (revenue minus deductible costs, according to Presidential Decree No 917/86), and subject to VAT and withholding tax on invoices.

The social security management of the freelance photographer

The subjects who want to become professional photographers must also deal with social security obligations, which consist of registration to the Gestione Separata Inps (Law n. 335/95), and in the payment of annual contributions.

The Separate Account is the social security system where professionals who do not have an autonomous professional association come together. Contributions vary from year to year based on percentages established by the Inps and applied to professional income. These contributions falls due on the same dates as the income tax payment, 30 June and 30 November.

The important thing to emphasize regarding the figure of the professional photographer who acts as a self-employed is that both from a tax point of view and social security, taxation, and contributions are always derived from earnings received.

The professional determines his tax income from the difference between receipts received and costs paid. This means that taxes and contributions derive from what has been collected and delivered during the year, according to the tax rules laid down in Presidential Decree no. 917/86 (TUIR).

Photographer as a business activity (the photographic studio): Ateco tax rules and VAT number

Becoming a photographer and exercising an activity that concerns the commission for third parties and the marketing and resale of photos, photographic services, and graphic advertising services requires the existence of a fixed structure where you can offer these services to the public.

It can be a real shop and a photographic studio used for the exercise of the activity. In this case, the figure of the photographer can no longer be framed as a freelance professional. Still, it becomes a real craft business, as there is prevalence in the use of capital and organization in the industry compared to his talent.

The activity of a Photographer as a business requires the completion of certain obligations:

Opening of VAT number for photographers

Even in this case, the first requirement is still linked to the VAT number setup, which can be both individual and corporate. About this point, the same information as that previously seen for self-employment can be considered valid.

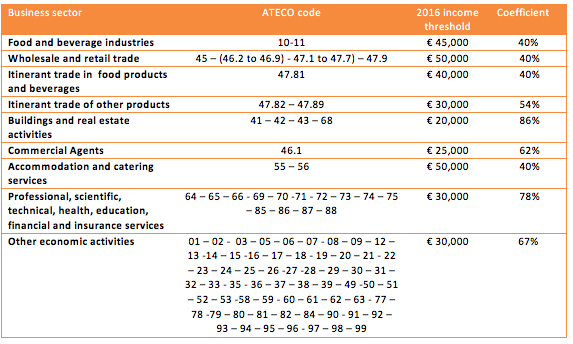

At the same time, also, in this case, it is necessary to choose the tax regime to be applied. Even for those who operate as sole proprietorships (not in the case of companies), you can join the so-called “Regime Forfettario” which we have seen for professionals. This regime, with different rules, is also applicable to those who carry out business activities.

The entry requirements are the same, only the volume of annual revenue changes, which goes to €. 50,000, with a compensation percentage of 40%. Also, in this case, the taxation is carried out based on revenues received and costs incurred during the year.

For those who cannot benefit from this favorable regime, the alternative is simplified accounting, which provides for determining income according to the cash basis. It is foreseen that the taxable income is subject to Irpef and Irap, in addition to the keeping of VAT registers, for the annotation of the active and passive operations relevant to the tax.

Are photographers required to register at the Chamber of Commerce?

The exercise of a business necessarily entails registration with the Chamber of Commerce of the province where the activity is carried out.

The registration is carried out using a telematic procedure (with digital signature), and at the same time, the registration in the Register of Artisans will be carried out. Registration with the Chamber of Commerce involves the payment of annual fees, which varies for each type of business (about €. 150.00).

Gestione Artigiani Inps

The owners of the activity are obliged to enroll in the Gestione Commercianti e Artigiani Inps. This is a compulsory requirement, which provides for the payment of fixed contributions, regardless of the income generated by the activity, divided into as many annual installments, for about € 3,800.00.

In addition to these contributions, if the income deriving from the activity exceeds the minimum income foreseen every year by the Inps (€. 15.549,00), it is due to the payment of further contributions calculated on the income be paid at the deadlines foreseen for the payment of income taxes.

Additional obligations

Further obligations are related to the payment of the Government Concession Tax – Payment is due if the incorporation takes place in the form of a company, to be made on the postal account 8003, for €. 309.87 – and also the registration with Inail.

For the exercise of a commercial enterprise, it is compulsory to register with Inail and pay the relative annual welfare charges (if you use electrical appliances of any kind or vehicles).

Photographer and copyright assignment

Alongside the two conventional forms of exercising the activity of Photographer, in the form of freelance or artisan enterprise, there is a different form of exercising the activity related to the sale of copyright on the works made.

This particular aspect has also been dealt with by the Revenue Agency, which has clarified this professional area with Resolution no. 94/E/1997, according to which, the transfer by the author of photographic works to third parties for the economical use of the same works by the latter must be carried out using the particular discipline linked to the exploitation of copyright, as per Law no. 633/1941.

Transfer of editorial images

When a photographer finds himself having to transfer an image for editorial purposes, the best solution is not to transfer the photo directly (also transferring all the rights connected to it) but to transfer the rights of use through the discipline of copyright.

However, this discipline cannot be applicable for advertising or commercial images (but only for images with editorial purposes). To be able to use the discipline linked to the exploitation of copyright, some requirements must be respected:

- These must be images with a creative edge;

- It must concern editorial uses: these are exclusively commercial or advertising uses of the work;

- A professional or an individual makes the transfer (cannot be made under a business regime).

If these requirements are met, the supply is made through the exploitation of copyright: the service will be considered outside the scope of application of VAT, as it is a work protected under Chapter I of the Law on copyright (on the other hand, transfers made by persons other than the author are subject to VAT, according to the second paragraph, no. 2 of Article 3).

Tax receipt for photographers

If these requirements are met, the service is documented not with an invoice but with a tax receipt, indicating an operation excluded from VAT, according to Article 3 of Presidential Decree no. 633/72. In this case, there is a flat-rate deduction of 75% of the income.

€. 1,000 of income only €. 750 are taxable. A 20% withholding tax will be applied to them on the receipt.

Such incomes will be indicated in the Unico form, in the RL panel dedicated to the so-called “different incomes,” according to article 67 of the DPR n. 917/86. The last essential aspect to remember about the sale of copyright is that this income, making applicable the flat deduction, can not be deducted analytically any expenses incurred by the photographer.

Finally, we would also like to remind you that this discipline is exempt from Inps contribution.

Opening a photography blog

We have decided to tackle one last topic related to the activity of the professional photographer. Very often, photographers use their websites to publish and promote their creations.

The management of this internet space related to the activity can represent, in some cases, a real tool to expand its commercial or professional network. Should you receive income from the exploitation of advertising services or the exercise of your professional activity, you must report it in your tax return as well as obtain a VAT number.

This is especially important for amateur photographers, who use blogs to seek customers to sell their creations. In all these cases, it is appropriate to remember the requirements to be followed.