The tax authorities consider the sale of goods through e-commerce as a commercial activity. This means that its regular exercise necessarily requires the opening of a VAT number. If you want to start an e-commerce, you will find all the information you need to open in this article.

Would you like to open a website to sell in e-commerce? Or are you making sales on Shopify or Amazon and wondering if you are compliant with the Italian tax office?

Probably if you’re reading this article, you’re trying to answer these questions that plague all those who propose to open a site to sell online.

Starting a business on the Internet is an important step to take. However, that is why you should leave absolutely nothing to chance.

How to sell online? Possible alternatives

If you want to sell online, you have to identify the best way to do it. There are, in fact, three main channels for selling items or info-products online.

I’m talking about using:

- Sales channels are offered by third parties. I refer to online stores offered within websites. The most famous is Shopify, or Amazon itself, and finally Etsy if you sell items made with your own hands;

- Direct sales channels. I refer to the purchase of a domain and hosting on which to install a CMS;

- Affiliation channels. In this case, compared to the previous ones, you do not sell objects directly at our disposal, but you operate as intermediaries, receiving a commission on each sale made.

At this point, I’m sure you’re wondering which of these is the best sales channel.

If you are a hobbyist and you want to try to leap by selling the creations you make, I certainly recommend you start with an indirect sales channel. On the other hand, if you are a shopkeeper who wants to bring his shop online to have a second sales channel, I recommend buying webspace.

Finally, if you don’t want to have issues related to the warehouse, you can try affiliations or dropshipping sales.

E-commerce website: technical requirements

Once we’ve seen the channels available to us, let’s focus on the main online sales channel. That is an e-commerce portal.

First, before dealing with the tax aspects that we will see below, it is good to be clear about the technical aspects.

The choice of a platform and its contents. The selection of a salable product catalog. Finally, using payment and delivery methods. These are all aspects that you need to consider.

Let’s see in detail.

E-commerce: choosing the platform

You can rely on different types of platforms to build your e-commerce:

- Open-source systems. These are platforms licensed under the GNU (General Public License). License characterized by accessible and fully modifiable source code. Prestashop or Magento are some of the main open-source software in circulation.

- Rental platforms. With this system, you can get an e-commerce by paying a periodic rental, usually monthly. Often, the site is offered a package of services. So overdoing it with overly customized requests may be too expensive.

- Proprietary website. This is the solution that requires the most significant economic investment. This is because the website is entirely developed by one or more programmers who build it from scratch according to the company’s needs.

Always remember that there are so many e-commerce sites on the market today. For a user to choose to buy a product on your e-commerce is necessary or offer products that are not found elsewhere. Or that your e-commerce is different from others on the market. Maybe for catalog sales policies or payment/service.

The sales catalog and its organization

Choosing the product catalog is one of the elements that you need to pay close attention to.

Whatever your industry is, you need to choose your products carefully, constantly dividing them into categories.

Users of your e-commerce to get to the purchase must always find what they are looking for with ease.

What I can tell you from my experience is that you should only include in the e-commerce items that you can manage. It is useless to have a large warehouse, which absorbs liquidity if you do not have a wide rotation of products. Better than to have few products but expendable on the market.

It is essential to work on the SEO side to correctly compile the product sheets, enriching them with quality photos and exhaustive descriptions.

Without forgetting that in the big e-commerce portals, people are pushed to purchase thanks to the reviews received. So try to entice people to leave their opinion on the portal and the products purchased.

E-commerce and payment methods

Even your choice of payment method can make the difference between you and your competitors.

If you want to be successful with your online store, you have to be competitive and put your customers to buy in different ways.

Bank transfer, prepaid cards, cash on delivery, point-of-sale pickup PayPal and Stripe will not be missed.

E-commerce companies usually accept credit card payments through the POS system offered by banks or through PayPal, a secure system designed for online transactions.

Not implementing one of these payment systems means cutting off a portion of users interested in purchasing.

Delivery of the order to the customer

You’ll only be able to relax when the order is in your customer’s hands unless the customer asks for a refund or replacement. Something unfortunately frequent in some categories of goods, see clothing.

Many people underestimate this last step, but the choice of courier is crucial to satisfy your customers and keep them coming back to your e-commerce.

This is such an important choice that you need to take calmly and thoughtfully. The courier affects the transportation costs, so you have to evaluate the cost-benefit ratio carefully. Every aspect of your e-commerce must be taken care of and chosen with the utmost attention. Users now know immediately if a portal is safe and reliable.

Importance of Search Engine Optimization (SEO) in E-commerce

Having reached this point, your e-commerce is well on its way, but it’s not over yet.

Even if the portal is active, you need to make sure that it can be found on search engines.

That’s why without a SEO specialist at your disposal, it’s hard for an e-commerce business today to stay up for more than 18 months. However, if you made it through this deadline unscathed, then you have a good chance of being successful.

What you need to do is to build your website and product pages according to Google’s rules. Only in this way you can easily climb its search results and increase your online visibility.

Creation of marketing strategies and advertising campaigns

Your e-commerce business has one goal: to sell.

Everything must contribute to the conversion of a user into a customer. To do this, you must create a usable site, visible and devote part of your budget to paid advertising campaigns: from AdWords to Bing Ads up to the social advertising of Facebook Ads.

Decide in advance which channels to use and how many resources to invest in each. Remember to open a page on social media to promote your business or use the many channels made available by the network: profile on Youtube, blogs, discussion forums, etc…

You’ve laid the groundwork for your e-commerce; now you need to commit to making each point as good as possible; your success depends on each of them.

E-commerce website: compulsory tax and social security obligations

Once we have analyzed the technical aspects of starting an e-commerce business, we will look at the tax and social security aspects.

If you think that building an e-commerce is only technical, you are wrong. If you do not operate in compliance with tax, compliance will certainly incur penalties, which often result in the closure of the business.

That said, let’s get into the details of the tax and accounting requirements for starting an e-commerce business.

Is dropshipping without a VAT number possible?

Is it possible to operate an E-commerce (even drop shipping) in Italy without a VAT number? Is E-commerce without VAT number legal?

You must know that every person who habitually carries out an economic activity and creates a defined and stable organization is obliged to request the Revenue Agency to open its VAT number. Therefore, to do E-commerce (including dropshipping), you need a VAT number.

E-commerce and occasional services up to 5,000 euros

Another question I’m often asked is about the possibility of doing E-commerce (including dropshipping) using occasional services. What you need to know is that occasional services only concern activities:

- Not habitual or continuous over time;

- Not organized.

As you have seen above, this means that for e-commerce is impossible to use the occasional service (you need a VAT number).

Concerning the limit of compensation up to 5,000 euros, you should know that fiscally this limit does not exist (any rule does not govern it). Those who carry out occasional activities (without any organization, carried out in an occasional and episodic way) do not limit the fees they can receive. However, there is only the obligation, once the remuneration exceeds € 5,000.00, to pay social security contributions by registering to the Gestione Separata INPS.

In summary, open a VAT number for your e-commerce is a necessary requirement.

Temporary shop for max 30 days

Doing e-commerce without a VAT number is possible, for a limited time, and only on one condition. As mentioned, e-commerce is a commercial activity and always requires the opening of a VAT position.

However, to do this, it is necessary that the Municipality where you intend to start the business, i.e., the Municipality of your residence, provides for the opening of a temporary shop also for online activities. Furthermore, the municipalities allow physical shops to operate without VAT registration for a maximum of 30 days per year.

These are marketing possibilities. Through the opening of these temporary stores, the various brands, mainly fashion brands, can test new products, carry out targeted promotions at a local level, launch new collections or dispose of the remainders of the old ones, exploiting the scarcity effect deriving from the reduced opening time of the store, which can be active for a maximum of six months.

However, everything is tied to a maximum period of 30 days. Therefore, the temporary shop necessarily has this maximum duration.

How to operate a temporary shop for a maximum of 30 days

Let’s see, below, the steps to run a temporary shop for up to 30 days a year.

Authorization of the Municipality to the temporary online shop

You have to ensure that the Municipality where you intend to set up this temporary shop foresees the temporary shop for e-commerce. Not all municipalities are prepared for this eventuality. That’s why you have to agree with the SUAP (Sportello Unico Delle Attività Produttive) to understand if this possibility is foreseen.

Presentation of the SCIA for temporary shops

Present the SCIA (Segnalazione Certificata di Inizio Attività) at the Municipality where you intend to open your e-commerce. At the end of the 30 days, you are required to submit another SCIA to:

- Notify you of the termination of your business;

- Communicate the opening of the VAT number if you intend to continue the activity.

That described is undoubtedly the only helpful way to test your e-commerce activity without a VAT number. However, it must be a possibility allowed by the Municipality where you intend to operate.

E-commerce and opening a VAT number

As we have seen, the opening of the VAT number for an e-commerce is necessary:

- From the first day of business, if it is not possible to opt for the temporary shop period;

- From the 31st day after the opening of the temporary shop.

In both of these cases, you are obliged to open a VAT number. This numerical code uniquely identifies a person who operates on their own account, carrying out commercial activity.

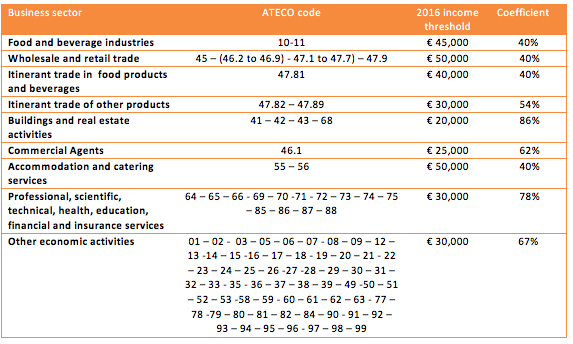

Each VAT number is associated with an activity code.

This is a code that allows identifying the economic activity carried out by each subject. For example, for e-commerce activities, the ATECO activity code to be used is as follows:

“479110 – retail sale of goods via the internet”.

When opening the VAT number, you will also have to choose, advised by your trusted consultant, the tax regime to be adopted to exercise your activity. Naturally, the home page must show the name of your sole proprietorship, the complete address, and the VAT number.

Registration in the Register of Companies held at the Chamber of Commerce

At the same time as the VAT number is opened, the company must be registered in the “traders” section of the business register of the relevant Chamber of Commerce.

This is an obligation to be carried out simultaneously as the opening of the VAT number. The registration in the register of companies has costs related to annual charges, for about a hundred euros per year.

Presentation of the SCIA in the Municipality

The last requirement is the declaration of commencement of activity to the Municipality.

The relevant Municipality is the one in which you have decided to establish the headquarters of your business. Even if you operate online, you will still need a fixed location to locate your business.

Even this requirement has charges, which vary from Municipality to Municipality, usually a few tens of euros. The important thing you must remember about this requirement is that you can start to operate concretely with your e-commerce only after presenting the SCIA.

E-commerce and mandatory social security obligations

The manager of an e-commerce site is required to enroll in the management of traders Inps. This is a social security system that provides for the payment of four annual installments of fixed contributions.

These are compulsory contributions to be paid irrespective of the income earned during the year. These contributions cover income up to about 15,000 euros. Above this threshold, further contributions are due, calculated on a percentage basis.

For more information on the management of traders, I refer you to this contribution: “Contributi Inps artigiani e commercianti.”

How much does it cost to open a VAT number in E-commerce?

As for the cost of opening a VAT number, it can vary, even a lot, mainly based on two factors:

- The fees to be paid to the Chamber of Commerce and the Municipality (vary from a minimum of € 53.00 to a maximum of € 128.00);

- The legal form of the company.

Invoicing for VAT purposes in E-commerce

When you decide to start an e-commerce business, it is also good to know how to treat the sales you make from a tax perspective. For this reason, it is good to know the differences between direct and indirect e-commerce.

From a tax point of view, making one type of sale rather than another involves significant differences.

Electronic commerce is the conduct of business activities and transactions by electronic means and includes the marketing of goods, the provision of services, and the marketing of digital products.

Based on the delivery of purchased products, e-commerce can be divided into:

- Direct E-commerce, when the transaction and the good exchanged are online;

- Indirect e-commerce, when the transaction is online, but the good is physical.

Let’s look at the differences in detail.

Direct E-commerce

In direct e-commerce, the entire transaction, order, delivery, and payment are carried out entirely electronically.

This is the sale of intangible virtual products (software, websites, images, text, films, and music) acquired through user “downloads.”

Well, from the point of view of Value Added Tax, these operations are assimilated to the provision of services, which provide for the following invoicing rules:

- Business-to-business services – Services provided between two persons liable for VAT fall within the scope of Article 7-ter c.1 letter a) of Presidential Decree no. 633/72. Therefore, these services are taxed in the place of establishment of the client, regardless of the residence of the supplier and the place where the service is performed (sale of software between two Italian companies – the supplier issues an invoice with VAT). If one of the parties is from the European Union, the party liable for VAT must issue an invoice not subject to VAT. On the other hand, the party receiving the invoice must integrate it with the reverse charge mechanism within the month of receipt;

- Business-to-consumer services – Services provided between a VAT taxable person and a private individual fall within the scope of Article 7-ter, paragraph 1, letter b). According to this article, services are considered to be carried out in the State’s territory when they are supplied by taxable persons established in the territory to non-taxable customers. For example, an Italian company sells a film downloaded from the Internet to a private individual. The domestic operator issues an invoice with VAT.

Indirect E-commerce

In indirect e-commerce, the sale takes place electronically, but the delivery of the goods takes place through traditional channels (delivery of the goods by carrier or shipper).

For VAT purposes, these transactions are treated as mail orders.

In particular, these are supplies of goods that are not subject to the obligation of invoicing (unless requested by the customer) nor to the duty of certification through the issuance of a receipt or fiscal receipt.

Sales receipts must be recorded in the appropriate register. Let’s see now the cases we can have:

- Business-to-business services – Services provided between two VAT registered companies must be settled by issuing an invoice, in any case, as provided for by Presidential Decree no. 633/72.

- Business to consumer services – Transactions carried out between a seller subject to VAT in our country and a private individual must be recorded in the register of receipts and are subject to VAT or invoiced but only at the customer’s request. If, on the other hand, the taxable person is a private individual resident in an E.U. country, VAT must be applied in Italy if the amount of the supplies made in the purchaser’s country exceeded the threshold of €79,534.36 in the previous or current year. On the other hand, the Italian VAT subject is obliged to identify himself for tax purposes in the Community country to apply VAT in the country of destination.

Hi, I’m interested in setting up an e-commerce business in Italy. I’m wondering if you could provide some more information about the process, such as the necessary licenses and permits. Thanks!

Sure I can. please use the below form to contact our team

Thank you for your dedication to sharing knowledge. Your article is outstanding.

I read many of your blog posts, and they’re consistently excellent. Keep it up!

Thanks a lot very much for this expert and sensible guide. Your blog is a great mix of fun and informative content. Thanks for keeping it interesting!

Cool post! Your innovative approach is what keeps me coming back for more.

I’ve learned so much from this article. Thank you for putting it together!

A very comprehensive and enlightening article. Thanks for writing this up!

I found your article very beneficial. Thanks for sharing these valuable insights!

Your writing style is excellent, and the article was easy to understand. Thanks!

Your article was brilliantly written. Thanks for providing such valuable information!

Youre so cool! I dont suppose I’ve read anything like this before. So nice to search out any individual with some unique ideas on this subject.

Much appreciated! Your article helped clarify a lot of things for me.

Thanks for this excellent piece! It was both enlightening and thought-provoking.