Employment income taxation for posted workers in Italy employed by EU based companies. Sanctions in the case of posting of fictitious personnel.

In human resources management, the instrument of staff secondment is a widely used tool, especially in large corporate groups with headquarters (legal and/or operational) in various countries. In this article, we will analyze how a foreign worker who is transferred to Italy on secondment is taxed.

Secondment of staff: characteristics

Personnel posting involves three parties: the posting employer, who, for his interest, makes one of his employees available to a party; the posting employer/user, who benefits from the work of the posted employee; and the employee, who will provide his work for the benefit of a third party other than the one with whom he has entered into a contract of employment.

Contractual aspects

There are two contractual aspects to posting: the first is the employment contract linking the employer and the employee. It is based on this link (and of Articles 2086 and 2094 of the Civil Code) that the employer has the power to post his employee to a third party and, at the same time, the latter is obliged (except in the case of publishing with a change of duties) to carry out the employer’s instructions.

Instead, it is a civil law contract that binds the posting employer to the employer/user, a contract that should be formalized in writing, indicating in detail the aspects related to the management of the worker by the user and the economic aspects between the two employers.

Posting of staff is lawful provided that there is an “interest” on the part of the posting employer, that the work is “determined,” and that the posting is temporary.

Posting of personnel in Italy: taxation

The employee posted abroad is a tax resident of Italy, according to Article 2 of Presidential Decree no. 917/86, and remains subject to taxation in Italy, for income tax purposes, on the so-called “conventional wages.” This is the case in which the posted worker meets the relevant conditions of application: an exercise of the work activity abroad for more than 183 days in 12 months.

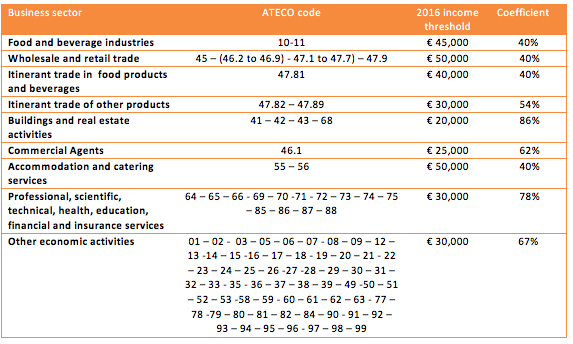

On the contrary, in the case of employees of companies located in a foreign country (EU), seconded to an associated Italian company, they are subject to taxation in Italy, for income tax purposes, on an “analytical” basis in the sense that the ordinary rules of income from employment apply, as per Article 51, paragraphs 1 to 8 of Presidential Decree No. 917/86. This is because it is impossible to use the rules provided by paragraph 8-bis of the same article, which is provided only for workers abroad. However, this aspect may be considered objectionable, as it is detrimental to the general principle of free movement of workers.

Directive 2014/67/EU

The regulatory provision analyzed above must be harmonized with Legislative Decree no. 136/2016, implementing the European Directive no. 2014/67/EU. In particular, the Decree provides that the employment relationship between the companies concerned and the posted workers shall be subject, during the post, to the same working and employment conditions offered to workers performing similar subordinate work in the place where the posting takes place.

Authenticity of detachment

Legislative Decree no. 136/2016 introduced these new provisions to counter the phenomenon of fictitious allocation by an employer in EU states with less stringent contribution regimes than the Italian one. For this reason, a series of strict provisions are dictated to ascertain the authenticity of the posting.

In particular, Article 3 of Legislative Decree no. 136/2016 provides that to ascertain whether the seconding company is exercising activities other than those of mere management or administration of employees, several elements are assessed, including:

- The administrative headquarters, offices, departments, or production units;

- The Chamber of Commerce registration;

- The place where the workers are employed and the place from which they are posted;

- Location of the company’s main economic activity and where its administrative staff are employed;

- The number of contracts performed or the amount of turnover achieved by the undertaking in the Member State of establishment considers the specificity of small and medium-sized enterprises and newly established undertakings.

Control elements

Furthermore, to ascertain whether the employee is truly posted, the inspection bodies are required to assess several elements, including:

- The content, nature, and manner of employment and the remuneration of the employee;

- The fact that the worker habitually carries out his activity in the Member State from which he is posted;

- The temporary nature of the work carried out in Italy;

- The fact that the worker has returned or is expected to return to work in the Member State from which he was posted;

- The circumstance that the employer who posts the worker provides for travel, board, or lodging expenses;

- any previous periods during which the same activity was carried out by the same or another posted worker;

- The existence of the certificate relating to social security legislation.

Effects of fictitious posting

Should the posting not be authentic, the employee is considered employed by the person who used the service, and therefore subject to Italian taxation.

In such cases, the sanctions framework applies to both parties involved: the person making the posting and the person who used the services of the posted workers are punished with a monetary administrative sanction of €50 for each worker employed and for each day of employment. In any case, the amount of the fine may not be less than €5,000 nor more than €50,000.