After a long and daunting incubation period, on April 4th 2024, the Digital Nomad VISA decree was published in the Italian Gazette at record n. 79; This groundbreaking decree clarifies and eliminates uncertainties surrounding the pathway for digital nomads and remote workers. Italy has officially joined the ranks of countries offering a welcoming embrace to this dynamic and growing community, and we are thrilled to share this exciting news with you. Read the full article and discover if the Digital Nomads VISA works for you.

Who qualifies for the Italian Digital Nomad Visa?

While the initial impression might suggest that anyone working remotely or living a nomadic lifestyle would qualify, the reality is more nuanced. Article 1, Paragraph 2 of the decree defines the beneficiary category as “citizens of non-European Union countries, here in after referred to as foreigners, who engage in highly qualified work through the use of technological tools that allow remote work, either independently or for a company not resident in the national territory.”

Italian Digital Nomad Visa’s Essential Criteria

Delving into the specifics, let’s break down the essential criteria outlined in the decree:

- «attivita’ lavorativa altamente qualificata», High skill activity as defined by art. 27-quater, comma 1, del decreto legislativo 25 luglio 1998, n. 286;

- «nomade digitale», Digital Nomad who runs his/her freelance business using remote technology tools

- «lavoratore da remoto», Remoter Worker employed by an Italian or non Italian entity.

Qualifications for the High Skills Activity

In regards to the High Skills activity, it’s crucial to understand that the applicant must either:

- Have a tertiary-level education degree (University( issued by the relevant authority in the country of completion, confirming the successful completion of a program lasting at least three years, or a post-secondary qualification lasting at least three years, equivalent to at least level 6 on the National Qualifications Framework;

- Meet the requirements outlined in Legislative Decree No. 206 of November 6, 2007, specifically related to regulated professions (doctors, lawyers, accountants etc.);

- Hold a superior professional qualification supported by at least five years of professional experience at a level comparable to tertiary-level education qualifications, relevant to the profession or sector specified in the employment contract or binding offer.

- Possess higher professional qualification backed by a minimum of three years of relevant professional experience gained within the past seven years. This particularly applies to executives and specialists in the information and communication technology sector, as classified under ISCO-08, No. 133 and No. 25.”

The easiest route to this is to hold a three-year college degree. It’s important to point out that the applicant needs to meet one of the four criteria, while the activity performed is not relevant or congruent.

Just as an example, if you hold a four-year bachelor’s degree in Economics, you meet the criteria, regardless of your job/occupation.

Italian Digital Nomad VISA Qualifying criteria

Article 3 then provides additional criteria to meet in order to apply for the Italian Digital Nomad VISA at the Italian consulate located in your jurisdiction:

- Have an annual income in excess of three times the minimum level required for exemption from healthcare costs (currently set at EUR 28,000);

- Possess valid private health insurance covering medical care and hospitalization for the entire duration of their stay (365 days);

- Provide appropriate documentation related to accommodation arrangements in Italy prior your arrival (such as a Declaration of Hospitality, rental agreement, or proof of property ownership in Italy);

- Demonstrate a minimum of six months’ prior experience in the field of work they intend to pursue as a digital nomad or remote worker;

- Submit the relevant employment contract, collaboration agreement, or a binding offer if applying as remote workers, indicating compliance with the requirements specified in Article 27-quater, paragraph 1, of Legislative Decree July 25, 1998, no. 286.

The above mentioned documents must accompany the VISA application form, the VISA application fee, and a travel reservation to Italy.

What Happens Once you Obtain Your Digital Nomads VISA?

Once the local Italian consulate stamps the Italian Digital Noma VISA on your passport, you can finally board your plane to Italy, and begin your new Italian chapter.

Within 8 days from your arrival in the Schengen Territory, you must lodge in the Italian immigration office appointment request through any local post office. Note that not every post office in Italy carries the facility to book such appointments; you must therefore check if the Post office displays the “Sportello Amico” badge.

We strongly advise you to check this beforehand, and to avoid any long queue you can book the post office meeting by downloading the Ufficio Postale app. This will save you a lot of time!

The residence permit is granted for a period of up to one year, and you can renew it with no restrictions as long as you maintain all of the requirements. In addition, you can sponsor your spouse and/or minor children or elder parents under the general Family reunification pathway.

On top of the general revokement and voidance clauses, art. 4 par. 4 clearly states that the Residence Permit is not renewed or revoked if the statutory Income taxes and contributions are not paid.

Finally, the local immigration office files your personal details and your employment agreement (for remote workers only) to the tax office, the social security administration, and the labor office in order to facilitate inspections and audits.

What Happens With your Taxes? Should you Pay Taxes to Italy?

Once you obtain the residence permit and settle in Italy you are required to become a tax resident, paying taxes on your employment/self employment income, as well as social security on your earnings.

Generally you are not required to contribute towards the Italian Social Security in case of secondment, A1 coverage, or other international assignment to Italy. In particular US citizens must opt for the US coverage, abiding the US – Italy social security agreement, thus paying social security to the United States only, and pay income tax to Italy. In order to do that, you must obtain the US Social Security Certificate of Coverage.

This becomes essential to avoid any unwanted challenge from the INPS – Italian Social Security Administration.

Two Partita IVA Regimes for Digital Nomads in Italy

Digital nomads must trade from Italy under the Partita IVA, and can essentially pick between two regimes:

Regime Forfettario

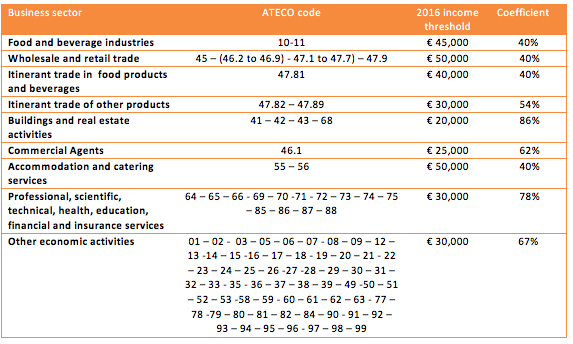

The first one allows you to pay tax using a flat 5% tax scheme for 5 years (which increases to 15% in the subsequent years), on a set percentage of your revenues. For instance, if you are a computer programmer and you invoiced € 50,000, your taxable income is adjusted to 67% (€ 33,500) on which you pay a 5% income tax amounting.

This regime is non VAT registered, and you don’t charge any output VAT; moreover, your income calculation disregards the applicable costs.

The Regime Forfettario is better suited to Digital Nomads earning up to € 85,000/year with minimal to no costs, such as digital marketers, SEO specialists, computer programmers among others.

New Residents Regime

The new residents scheme provides a 50% income tax exemption for up to 5 years. This regime allows the cost itemization, therefore you can reduce your revenue by the costs incurred in the trade; furthermore, you charge output VAT and deduct any VAT incurred. In addition, you can write off tax credits, including the health expenses, house renovations, rental costs among others.

The new residents regime is better suited for individuals trading with companies located overseas (no VAT) who also incur in trade costs.

Regardless of the tax regime you pick, you are also required to pay tax on your worldwide income, thus your foreign (non Italian) financial income sources, rentals, royalties, and any other income source has to be disclosed to the Italian authorities through your annual self assessment tax return.

In addition, you must also report your non Italian assets, and potentially pay wealth tax on such items.

The Italian Digital Nomad VISA Conclusions – Pros and Cons

The Digital Nomad VISA carries various valid points:

- No Clearances needed from Italy

- Little proven experience needed

- Tax code (Codice Fiscale) released alongside the residence permit application

- No immigration quota applicabile

- Access to the permanent EU card

- Possibility to be employed by a foreign entity

However, there are some areas of concern:

- No free healthcare;

- Enhanced information exchange between the tax office, social security office, and the immigration office;

- No clarity on VISA conversion to other categories;

- High minimum income requirement

From the law, it appears that you can be hired by your own foreign entity, thus qualifying for the remote worker status.

Don’t forget there are various immigration paths to Italy such as the Representative Office VISA, and the Elective Residence VISA.

Accounting Bolla is the Italian leading Taxes and Immigration firm working remotely. Get in touch with us to obtain the best immigration and tax strategy for your relocation to Italy.